How to Analyze Financial Statements: Vertical Method

As said in previous articles, we have two primary methods to analyze financial statements. Here you will learn how to use both steps by step.

The first method, known as the vertical method, analyzes one fiscal year’s financial information to determine financial statement accounts’ participation in the total of assets, liabilities, and equity in the Balance Sheet or sales in the Profit and Loss statement.

The vertical method uses integral percentages, which means relate each account of the financial statement with a base account valued as 100%.

We assign total assets 100% in the balance sheet and compare it with their accounts’ net values to get each account’s proportion against the full inversion.

Using the same liabilities and equity technique, we compare each account with total liabilities plus equity valued as 100%.

We assign total liabilities and equity 100% to compare with the total liabilities plus equity valued as 100% using the same technique.

On the Profit and Loss statement, total sales, or total income, has a value of 100% and the rest of the accounts use this value as a base percentage for comparison.

To ensure proper analysis, we recommend going through the following steps:

Step #1

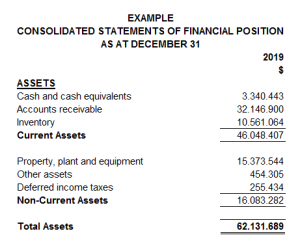

Having the financial statements in an Excel format will be easier to make the necessary calculations. Make sure you include the complete accounts next to their amounts and the year correspondence. In the following example, we can see how it must look.

|

Step #2

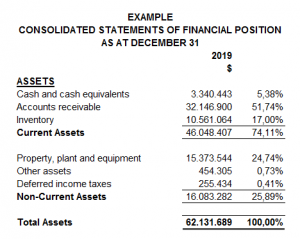

Include a column next to the amounts inserted to be used to present the percentages. The vertical method divides each account’s value between the total assets, liabilities plus equity, or income.

In this example, you can see those basic accounts:

|

Step #3

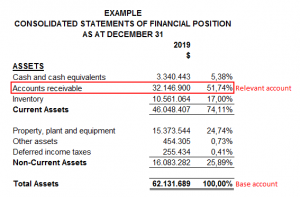

Once you obtained the percentages, you will see on the financial statement how much each account represents and which one is the most or less “important” in terms of inversion.

In this example, accounts receivable have all our attention because it represents more than 50% of the company assets. We chose it because it accounts for more weight, value, or effect in the total assets.

|

Step #4

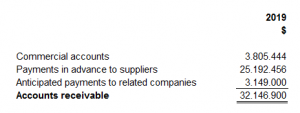

Focusing on one account, we have to investigate by looking into its composition. For example, are those accounts receivable form with debts of the company’s associates or clients? Is the total amount composing of national or foreign currency?

You could get that information by having an interview with the accounting department, the administrator, or even directly by the company’s owner; if audited financial statements are available, you could read it from its notes.

In our example, we can see that accounts receivable are composed of commercials or clients’ accounts, payments in advance to suppliers, and prepaid payments to related parties or companies.

|

Step #5

Finally, we must determine the effect of the account. In this case, our conclusion will be as follow: In 2019, the total assets had a value of 62,131,689, representing 100% of the account, which has 74.11% of current assets and 25.89% of non-current assets. In those percentages, the most valued account is the accounts receivable with 51.74%.

These steps can help us understand that most assets are not liquid. As users of the financial statements, we could investigate when those people will pay the company or compensate with accounts payable and the clients, related companies with debts, etc.

Written by: Andrea Diaz

Related Articles:

Newsletters

Newsletter December 2021

NewslettersEvents & SponsorshipArticles & Publications

Newsletter – June 2021

NewslettersEvents & SponsorshipArticles & Publications

Newsletter – May 2021

NewslettersEvents & SponsorshipArticles & Publications

Newsletter – April 2021

NewslettersEvents & SponsorshipArticles & Publications

Newsletter – March 2021

NewslettersEvents & SponsorshipArticles & Publications

Events & Sponsorship

Toronto Entrepreneurs Conference @ Mississauga

May 08, 2019 Our B.E.S.T. (Business Entrepreneurs Services Team) Group has participated in this event for first time. Toronto Entrepreneurs Conference and Trade Show is the largest Entrepreneurs event in Canada. The event which targets business owners, partners or...

Hispanic Fiesta 2018

September 04, 2018 RGB Accounting will participate in this event for a second year in a row. Hispanic Fiesta will be held at Mel Lastman Square in Toronto during the Labour Day Weekend, August 31st, Sept. 1, 2, & 3, 2018. Hispanic Fiesta is a four-day celebration...

Secure Your Future Seminar 2018

June 20, 2018 This event gathered business owners running a small or medium-sized business, self-employed and incorporated businesses willing to learn tax saving strategies to help them utilize their company assets to secure their retirement. We are proud of having...

2nd Latino Business Expo Show

May 19, 2018 The 2nd Latino Business Expo Show held on May 19th at Daniels Spectrum gathered a wide range of entrepreneurs and business owners avid to learn how to take their businesses to the next level. RGB Accounting participated as vendor and speaker at this...

Hispanic Fiesta 2017

September 04, 2017 Hispanic Fiesta, a celebration of Spanish and Latin-American: Arts, Food, Music and Entertainment, is a four-day celebration filled with the splendid sounds, tempting treats and colorful culture featuring 300 local, national and International...

Articles & Publications

The Surprising Medical Expenses You Can Claim with the CRA!

The Surprising Medical Expenses You Can Claim with the CRA! In the realm of medical expenses, which are often deemed both essential and financially burdensome, the Canada Revenue Agency (CRA) emerges as a potential source of relief for Canadians. While the CRA...

Shareholder Owners Salaries vs Dividends

NewslettersEvents & SponsorshipArticles & Publications

Understanding the Shareholder Loan

Understanding the Shareholder Loan. How to Use it to your Advantage and Stay Compliant with CRA If you are the owner-manager of a corporation, understanding the concept of the shareholder loan is essential to running your business. Below I will explain what a...

GST/HST for digital economy businesses

GST/HST for digital economy businesses Overview New rules for digital economy businesses are in effect as of July 1, 2021. As of July 1, 2021, digital economy businesses, including digital platform operators, may have potential goods and services tax/harmonized sales...

Ten things to know before filing your tax return this year

Ten things to know before filing your tax return this year Here are ten things to keep in mind as you work your way through this tax season. The deadline The regular tax-filing deadline for most individuals is usually April 30, but you have until May 2 this year to...