How to Analyze Financial Statements: Vertical Method

As said in previous articles, we have two primary methods to analyze financial statements. Here you will learn how to use both steps by step.

The first method, known as the vertical method, analyzes one fiscal year’s financial information to determine financial statement accounts’ participation in the total of assets, liabilities, and equity in the Balance Sheet or sales in the Profit and Loss statement.

The vertical method uses integral percentages, which means relate each account of the financial statement with a base account valued as 100%.

We assign total assets 100% in the balance sheet and compare it with their accounts’ net values to get each account’s proportion against the full inversion.

Using the same liabilities and equity technique, we compare each account with total liabilities plus equity valued as 100%.

We assign total liabilities and equity 100% to compare with the total liabilities plus equity valued as 100% using the same technique.

On the Profit and Loss statement, total sales, or total income, has a value of 100% and the rest of the accounts use this value as a base percentage for comparison.

To ensure proper analysis, we recommend going through the following steps:

Step #1

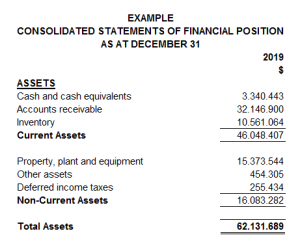

Having the financial statements in an Excel format will be easier to make the necessary calculations. Make sure you include the complete accounts next to their amounts and the year correspondence. In the following example, we can see how it must look.

|

Step #2

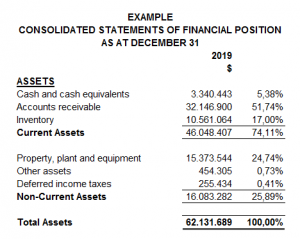

Include a column next to the amounts inserted to be used to present the percentages. The vertical method divides each account’s value between the total assets, liabilities plus equity, or income.

In this example, you can see those basic accounts:

|

Step #3

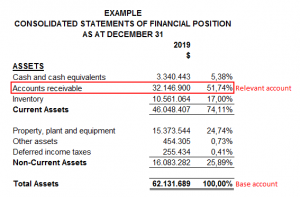

Once you obtained the percentages, you will see on the financial statement how much each account represents and which one is the most or less “important” in terms of inversion.

In this example, accounts receivable have all our attention because it represents more than 50% of the company assets. We chose it because it accounts for more weight, value, or effect in the total assets.

|

Step #4

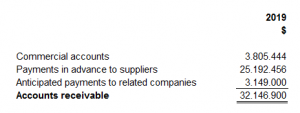

Focusing on one account, we have to investigate by looking into its composition. For example, are those accounts receivable form with debts of the company’s associates or clients? Is the total amount composing of national or foreign currency?

You could get that information by having an interview with the accounting department, the administrator, or even directly by the company’s owner; if audited financial statements are available, you could read it from its notes.

In our example, we can see that accounts receivable are composed of commercials or clients’ accounts, payments in advance to suppliers, and prepaid payments to related parties or companies.

|

Step #5

Finally, we must determine the effect of the account. In this case, our conclusion will be as follow: In 2019, the total assets had a value of 62,131,689, representing 100% of the account, which has 74.11% of current assets and 25.89% of non-current assets. In those percentages, the most valued account is the accounts receivable with 51.74%.

These steps can help us understand that most assets are not liquid. As users of the financial statements, we could investigate when those people will pay the company or compensate with accounts payable and the clients, related companies with debts, etc.

Written by: Andrea Diaz

Related Articles:

Newsletters

Newsletter – February 2021

NewslettersEvents & SponsorshipArticles & Publications

Newsletter – January 2021

NewslettersEvents & SponsorshipArticles & Publications

Newsletter – December 2020

NewslettersEvents & SponsorshipArticles & Publications

Newsletter – October 2020

NewslettersEvents & SponsorshipArticles & Publications

Newsletter – September 2020

NewslettersEvents & SponsorshipArticles & Publications

Events & Sponsorship

Talent Kids Event 2017

August 19, 2017 RGB Accounting has proudly sponsored the 2017 Talent Kids event organized by Pecora Events on August 19th. RGB Accounting wants to thank organizers, presenters, judges, and all participants for making this a great event. Here we share some of the...

Los Nocheros USA/Canada Tour 2017

June 02, 2017 Argentina's biggest folkloric phenomenon arrived in Toronto, Canada to celebrate its 30 years trajectory. RGB Accounting was one of the sponsors of the event. More from our blog Newsletters Events & Sponsorship Articles &...

2nd Latin American Entrepreneur Conference

May 29, 2017 The Entrepreneur Conference was organized by the City of Toronto's Economic Development & Culture department in partnership with the Latin American Bi-Lateral Trade Initiative (LABTI) which consists of the Consulate Generals of Argentina, Brazil,...

Tax Season 2017 at La Liga Indoor Soccer

April 29, 2017 RGB Accounting has been sponsoring social events to promote cultural values in the hispanic community of Toronto and the GTA. The During the last tax season, RGB Accounting helped many individuals and small business owners to prepare their taxes,...

Articles & Publications

Home office expenses for employees

Home office expenses for employees Calculate your expenses To understand the math behind the home office expenses calculation, refer to how the claim is calculated. To use the calculator, select from the options below. A temporary flat rate of $2 for each day you...

Tax impacts of leaving Canada to live elsewhere

Tax impacts of leaving Canada to live elsewhere. You must carefully consider numerous tax impacts before deciding to leave Canada to live elsewhere. Analyzing the termination of your tax residence is a question of fact. Generally, the Canada Revenue Agency will...

Selling your business shares to a family member?

Selling your business shares to a family member? A new law means significant tax relief when you pass your business on to your kids. A recent change to Canada’s Income Tax Act (ITA) could reduce the tax sting associated with selling your business shares...

Tax changes in the latest fiscal update.

Tax changes in the latest fiscal update. If you're working from home, you can claim up to $500 for office expenses with the temporary flat rate method There were very few broad-based tax changes in the recently released federal government's fall economic statement....

COVID-19 Update January 2022

COVID-19 Update Federal Expanding Access to the Local Lockdown Program (December 22, 2021) The Department of Finance announced that the government intends to expand the Local Lockdown Program eligibility to access the wage and rent subsidies to more...