Fundamentals of Financial Statements Analysis

Financial Statement analysis is carried out through methods, often defined as techniques that allow knowing the entity’s transactions on its financial situation and results.

Based on the order to follow the analysis, these methods simplify and separate the financial statements’ numerical data from measuring the relationships in one period or the changes in several accounting years.

Based on the comparison of values, vertically or horizontally, analysis methods are defined as the Vertical and Horizontal methods.

Vertical Method

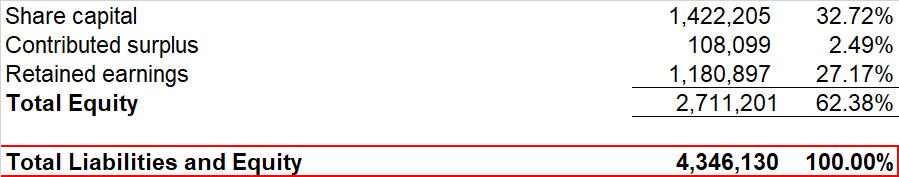

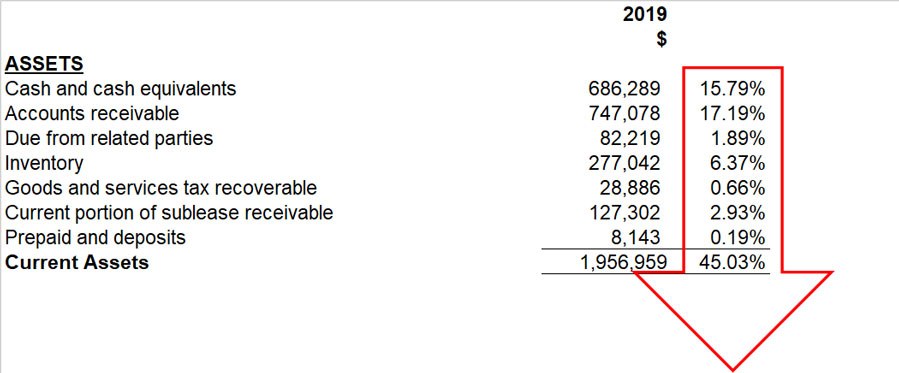

The Vertical method consists of analyzing the financial information of a single year to determine the participation of each account in the Financial Statement regarding total assets or total liabilities and equity, in the case of the Statement of Financial Position, or to the total sales, in the case of the Income Statement.

|

Statement of Financial Position Example |

|

| Income Statement Example |

|

The Vertical method, also called static because it applies to the same year’s financial statement, establishes comparisons between the same items vertically, studies the relationships between a company’s financial elements, and shows how values invested in it are distributed.

|

This method allows to know which items have predominance in the Financial statement understudy, weight the percentage of existing interrelationships between entities, and see the magnitude of importance they have within the financial information.

In the Statement of Financial Position, total assets get the value of 100%, and an account’s net value is compared to establish their proportional magnitude against the total investment. The same applies to liabilities and equities accounts, whose values compared with the total liabilities plus equity has a value of 100%. In an Income Statement, net sales get the value of 100%, and the rest of the accounts is compared against this base percentage.

Thus, this method reduces the amounts of the accounts of the same nature contained in the financial statements to percentages by dividing each one by the general group’s total to which they correspond. This procedure allows determining the weight of a particular account, indicating to the analyst in which accounts weaknesses, deviations, and abnormalities are observed to take corrective measures.

Horizontal Method

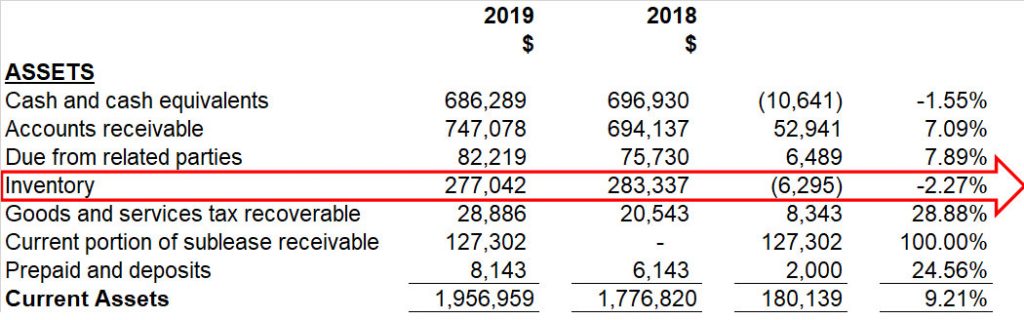

The horizontal method of analizing financial statements consists of comparing several years of financial statements, item by item, in a horizontal correlative manner.

Several successive years are usually studied; generally, at least the last year’s financial statements and the immediately previous year are included. A comparative examination between the two allows identifying the evolution of the different items.

The horizontal method can be understood as a dynamic analysis technique that deals with each account’s changes or movements between one period and another. This method relates the financial modifications suffered by the company, and its represented in increases and decreases, or even percentages, allowing a good view of obtaining the changes.

|

Analyzing increases and decreases consists of comparing homogeneous concepts of financial statements on at least two different dates locating the differences, and analyzing the figures’ behaviors from one period to another. The variation, positively or negatively, from one period to another is determined.

With these methods, business owners, banks, and others interested in understanding the financial statements can identify the variations that have occurred in the accounts in an obvious way and later determine the degree of impact on any company’s economic situation, be it small or medium.

Written by: Andrea Diaz

Related Articles:

Newsletters

Love Is in the Numbers ❤️ February Update from RGB Accounting

NewslettersEvents & SponsorshipArticles & Publications

Start 2026 with Confidence — RGB Accounting Expands Across Canada.

NewslettersEvents & SponsorshipArticles & Publications

Closing the Year with Purpose: RGB’s 2025 Journey

NewslettersEvents & SponsorshipArticles & Publications

Growth with Purpose — Remembering Our Roots, Reaching New Markets

NewslettersEvents & SponsorshipArticles & Publications

October at RGB Accounting: Gratitude, Growth & Smart Financial Moves 🍁

NewslettersEvents & SponsorshipArticles & Publications

Events & Sponsorship

Toronto Entrepreneurs Conference @ Mississauga

May 08, 2019 Our B.E.S.T. (Business Entrepreneurs Services Team) Group has participated in this event for first time. Toronto Entrepreneurs Conference and Trade Show is the largest Entrepreneurs event in Canada. The event which targets business owners, partners or...

Hispanic Fiesta 2018

September 04, 2018 RGB Accounting will participate in this event for a second year in a row. Hispanic Fiesta will be held at Mel Lastman Square in Toronto during the Labour Day Weekend, August 31st, Sept. 1, 2, & 3, 2018. Hispanic Fiesta is a four-day celebration...

Secure Your Future Seminar 2018

June 20, 2018 This event gathered business owners running a small or medium-sized business, self-employed and incorporated businesses willing to learn tax saving strategies to help them utilize their company assets to secure their retirement. We are proud of having...

2nd Latino Business Expo Show

May 19, 2018 The 2nd Latino Business Expo Show held on May 19th at Daniels Spectrum gathered a wide range of entrepreneurs and business owners avid to learn how to take their businesses to the next level. RGB Accounting participated as vendor and speaker at this...

Hispanic Fiesta 2017

September 04, 2017 Hispanic Fiesta, a celebration of Spanish and Latin-American: Arts, Food, Music and Entertainment, is a four-day celebration filled with the splendid sounds, tempting treats and colorful culture featuring 300 local, national and International...

Articles & Publications

Canada Budget 2025 Overview

Canada Budget 2025 Overview (RGB Accounting Blog Article — updated and expanded with verified sources) Introduction Released on November 4, 2025, the federal Budget 2025 is framed around three themes: Build, Protect, and Empower Canada. The government’s narrative is...

Canada’s New Voluntary Disclosures Program (VDP) – 2025 Overview

Canada’s New Voluntary Disclosures Program (VDP) – 2025 Overview (RGB Accounting Blog Article — updated and expanded with verified sources) Introduction Effective October 1, 2025, the Canada Revenue Agency (CRA) implemented major updates to the Voluntary Disclosures...

Incorporating Your Business in Canada: A Complete Step-by-Step Guide

Incorporating Your Business in Canada: A Complete Step-by-Step Guide Incorporating a business in Canada is a milestone that can transform how your company operates. From liability protection to tax advantages, incorporation is often the next logical step for...

Why ADP Payroll Is a Game-Changer for Canadian Small Businesses: Accuracy, Compliance & Peace of Mind

Why ADP Payroll Is a Game-Changer for Canadian Small Businesses: Accuracy, Compliance & Peace of Mind Managing payroll is one of the most critical—and complex—responsibilities for Canadian small businesses. From calculating source deductions to preparing T4 slips...

What You Need to Know: Key Tax Updates Heading into 2026

What You Need to Know: Key Tax Updates Heading into 2026? As we kick off the new year, keeping up with the latest tax changes can help you make smarter decisions about your income, payroll, and long-term financial planning. Here’s a breakdown of the most important...