How to Analyze Financial Statements: Vertical Method

As said in previous articles, we have two primary methods to analyze financial statements. Here you will learn how to use both steps by step.

The first method, known as the vertical method, analyzes one fiscal year’s financial information to determine financial statement accounts’ participation in the total of assets, liabilities, and equity in the Balance Sheet or sales in the Profit and Loss statement.

The vertical method uses integral percentages, which means relate each account of the financial statement with a base account valued as 100%.

We assign total assets 100% in the balance sheet and compare it with their accounts’ net values to get each account’s proportion against the full inversion.

Using the same liabilities and equity technique, we compare each account with total liabilities plus equity valued as 100%.

We assign total liabilities and equity 100% to compare with the total liabilities plus equity valued as 100% using the same technique.

On the Profit and Loss statement, total sales, or total income, has a value of 100% and the rest of the accounts use this value as a base percentage for comparison.

To ensure proper analysis, we recommend going through the following steps:

Step #1

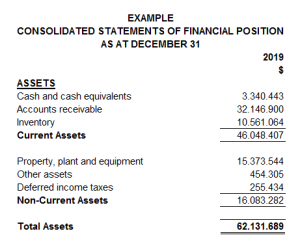

Having the financial statements in an Excel format will be easier to make the necessary calculations. Make sure you include the complete accounts next to their amounts and the year correspondence. In the following example, we can see how it must look.

|

Step #2

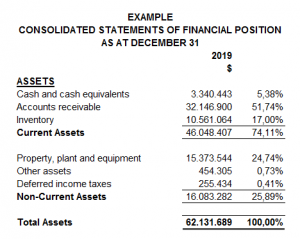

Include a column next to the amounts inserted to be used to present the percentages. The vertical method divides each account’s value between the total assets, liabilities plus equity, or income.

In this example, you can see those basic accounts:

|

Step #3

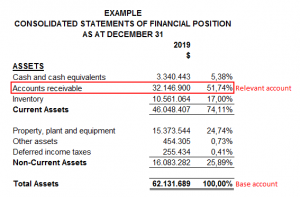

Once you obtained the percentages, you will see on the financial statement how much each account represents and which one is the most or less “important” in terms of inversion.

In this example, accounts receivable have all our attention because it represents more than 50% of the company assets. We chose it because it accounts for more weight, value, or effect in the total assets.

|

Step #4

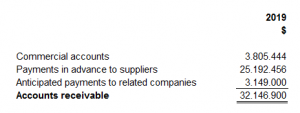

Focusing on one account, we have to investigate by looking into its composition. For example, are those accounts receivable form with debts of the company’s associates or clients? Is the total amount composing of national or foreign currency?

You could get that information by having an interview with the accounting department, the administrator, or even directly by the company’s owner; if audited financial statements are available, you could read it from its notes.

In our example, we can see that accounts receivable are composed of commercials or clients’ accounts, payments in advance to suppliers, and prepaid payments to related parties or companies.

|

Step #5

Finally, we must determine the effect of the account. In this case, our conclusion will be as follow: In 2019, the total assets had a value of 62,131,689, representing 100% of the account, which has 74.11% of current assets and 25.89% of non-current assets. In those percentages, the most valued account is the accounts receivable with 51.74%.

These steps can help us understand that most assets are not liquid. As users of the financial statements, we could investigate when those people will pay the company or compensate with accounts payable and the clients, related companies with debts, etc.

Written by: Andrea Diaz

Related Articles:

Newsletters

e-Newsletter – January 2018

NewslettersEvents & SponsorshipArticles & Publications

Events & Sponsorship

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Articles & Publications

Moving to the U.S. for more affordable Real Estate

Moving to the U.S. for more affordable Real Estate? Home prices have run-up in the U.S. but are mostly more affordable than major Canadian markets. Like many real estate markets worldwide, U.S. home prices have run up during the pandemic to the point of some saying...

New Goods and Services/Harmonized Sales Tax Rules

This article intends to illustrate how the new proposed Goods and Services/Harmonized Sales Tax (GST/HST) rules are to apply to the sale of goods made on July 1, 2021, or later, by a retailer that is a non-resident of Canada and not registered for GST/HST purposes,...

When withdrawing funds early from your RRSP makes sense

Most Canadians spend their working lives socking away as much money as they can in their registered retirement savings plans (RRSPs) — often feeling guilty if they’re not maxing out the contribution limits set by the federal government. Once retirement rolls around,...

Understanding the CRA Notice of Assessment

Understanding the CRA Notice of Assessment How to object if you think the CRA is wrong Most of us have received our Notice of Assessment from the CRA for our 2020 tax returns. Mostly it is pretty much as you expected – a refund or no balance owing. But sometimes, the...

A Guide to Bank Reconciliations

One of the most overlooked steps in the accounting process is completing a bank reconciliation. We'll take you step-by-step through the process of completing bank reconciliations for your business. In this day of electronic banking, many people believe completing a...