How to Analyze Financial Statements: Vertical Method

As said in previous articles, we have two primary methods to analyze financial statements. Here you will learn how to use both steps by step.

The first method, known as the vertical method, analyzes one fiscal year’s financial information to determine financial statement accounts’ participation in the total of assets, liabilities, and equity in the Balance Sheet or sales in the Profit and Loss statement.

The vertical method uses integral percentages, which means relate each account of the financial statement with a base account valued as 100%.

We assign total assets 100% in the balance sheet and compare it with their accounts’ net values to get each account’s proportion against the full inversion.

Using the same liabilities and equity technique, we compare each account with total liabilities plus equity valued as 100%.

We assign total liabilities and equity 100% to compare with the total liabilities plus equity valued as 100% using the same technique.

On the Profit and Loss statement, total sales, or total income, has a value of 100% and the rest of the accounts use this value as a base percentage for comparison.

To ensure proper analysis, we recommend going through the following steps:

Step #1

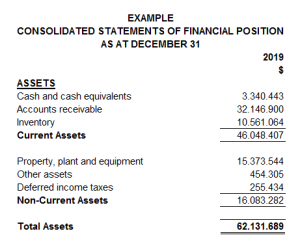

Having the financial statements in an Excel format will be easier to make the necessary calculations. Make sure you include the complete accounts next to their amounts and the year correspondence. In the following example, we can see how it must look.

|

Step #2

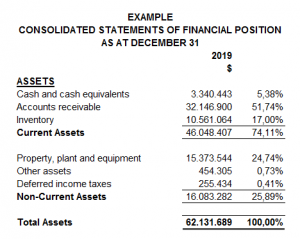

Include a column next to the amounts inserted to be used to present the percentages. The vertical method divides each account’s value between the total assets, liabilities plus equity, or income.

In this example, you can see those basic accounts:

|

Step #3

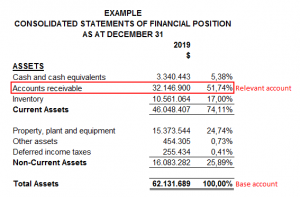

Once you obtained the percentages, you will see on the financial statement how much each account represents and which one is the most or less “important” in terms of inversion.

In this example, accounts receivable have all our attention because it represents more than 50% of the company assets. We chose it because it accounts for more weight, value, or effect in the total assets.

|

Step #4

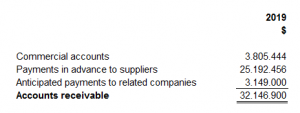

Focusing on one account, we have to investigate by looking into its composition. For example, are those accounts receivable form with debts of the company’s associates or clients? Is the total amount composing of national or foreign currency?

You could get that information by having an interview with the accounting department, the administrator, or even directly by the company’s owner; if audited financial statements are available, you could read it from its notes.

In our example, we can see that accounts receivable are composed of commercials or clients’ accounts, payments in advance to suppliers, and prepaid payments to related parties or companies.

|

Step #5

Finally, we must determine the effect of the account. In this case, our conclusion will be as follow: In 2019, the total assets had a value of 62,131,689, representing 100% of the account, which has 74.11% of current assets and 25.89% of non-current assets. In those percentages, the most valued account is the accounts receivable with 51.74%.

These steps can help us understand that most assets are not liquid. As users of the financial statements, we could investigate when those people will pay the company or compensate with accounts payable and the clients, related companies with debts, etc.

Written by: Andrea Diaz

Related Articles:

Newsletters

Newsletter – February 2020

NewslettersEvents & SponsorshipArticles & Publications

Newsletter – August 2019

NewslettersEvents & SponsorshipArticles & Publications

Newsletter – May 2019

NewslettersEvents & SponsorshipArticles & Publications

Newsletter – April 2019

NewslettersEvents & SponsorshipArticles & Publications

E-Newsletter – February 2019

Events & Sponsorship

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Articles & Publications

Do corporate loans count as taxable income?

Do corporate loans count as taxable income? When shareholders or employees borrow money from a corporation, that money is generally considered taxable income. But this rule, like many CRA rules, has exceptions. Many shareholders and employees borrow funds from their...

Beware of using your corporation’s income to pay personal expenses.

Beware of using your corporation's income to pay personal expenses. Suppose you own an incorporated business or professional corporation. In that case, it can be pretty tempting to pay for various personal expenses out of your corporation's income, but doing so is...

How the principal residence rule works

Principal Residence Rules Since 1982, each family unit (including you, your spouse or common-law partner, and any unmarried kids under the age of 18) has been able to designate one property as its principal residence for each calendar year. To simplify the...

Introducing the new Confirm my Representative service

The new Confirm my Representative service. On October 18, 2021, the Canada Revenue Agency (CRA) is introducing a new, two-step verification process to make authorizing a representative using Represent a Client more efficient and secure. The new process makes it easier...

The future of the COVID aid program

The future of the COVID aid program The CRB is one of three programs (alongside the Canada Recovery Caregiving Benefit and the Canada Recovery Sickness Benefit) that replaced the initial $2,000-per-month Canada Emergency Response Benefit (CERB) in September 2020. The...