How to Analyze Financial Statements: Vertical Method

As said in previous articles, we have two primary methods to analyze financial statements. Here you will learn how to use both steps by step.

The first method, known as the vertical method, analyzes one fiscal year’s financial information to determine financial statement accounts’ participation in the total of assets, liabilities, and equity in the Balance Sheet or sales in the Profit and Loss statement.

The vertical method uses integral percentages, which means relate each account of the financial statement with a base account valued as 100%.

We assign total assets 100% in the balance sheet and compare it with their accounts’ net values to get each account’s proportion against the full inversion.

Using the same liabilities and equity technique, we compare each account with total liabilities plus equity valued as 100%.

We assign total liabilities and equity 100% to compare with the total liabilities plus equity valued as 100% using the same technique.

On the Profit and Loss statement, total sales, or total income, has a value of 100% and the rest of the accounts use this value as a base percentage for comparison.

To ensure proper analysis, we recommend going through the following steps:

Step #1

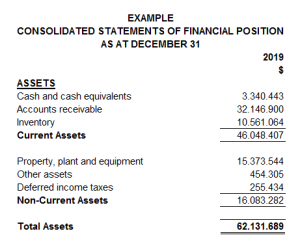

Having the financial statements in an Excel format will be easier to make the necessary calculations. Make sure you include the complete accounts next to their amounts and the year correspondence. In the following example, we can see how it must look.

|

Step #2

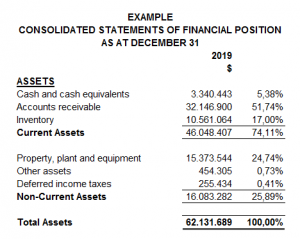

Include a column next to the amounts inserted to be used to present the percentages. The vertical method divides each account’s value between the total assets, liabilities plus equity, or income.

In this example, you can see those basic accounts:

|

Step #3

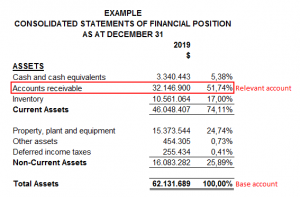

Once you obtained the percentages, you will see on the financial statement how much each account represents and which one is the most or less “important” in terms of inversion.

In this example, accounts receivable have all our attention because it represents more than 50% of the company assets. We chose it because it accounts for more weight, value, or effect in the total assets.

|

Step #4

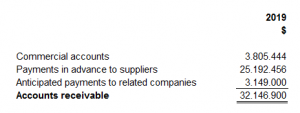

Focusing on one account, we have to investigate by looking into its composition. For example, are those accounts receivable form with debts of the company’s associates or clients? Is the total amount composing of national or foreign currency?

You could get that information by having an interview with the accounting department, the administrator, or even directly by the company’s owner; if audited financial statements are available, you could read it from its notes.

In our example, we can see that accounts receivable are composed of commercials or clients’ accounts, payments in advance to suppliers, and prepaid payments to related parties or companies.

|

Step #5

Finally, we must determine the effect of the account. In this case, our conclusion will be as follow: In 2019, the total assets had a value of 62,131,689, representing 100% of the account, which has 74.11% of current assets and 25.89% of non-current assets. In those percentages, the most valued account is the accounts receivable with 51.74%.

These steps can help us understand that most assets are not liquid. As users of the financial statements, we could investigate when those people will pay the company or compensate with accounts payable and the clients, related companies with debts, etc.

Written by: Andrea Diaz

Related Articles:

Newsletters

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Events & Sponsorship

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Articles & Publications

Changes to RRSP and CPP in 2021

The Canada Revenue Agency (CRA) has made annual announcements about the nation’s retirement programs. Namely, the Canada Pension Plan (CPP) and the Registered Retirement Savings Plan (RRSP) are being updated as we enter the new year. Here are the changes you need to...

CRA Collection Letters for CERB Ineligibility & Repayment

The Canada Revenue Agency has begun issuing formal collection letters for CERB repayment to recipients who may or may not have been eligible for the payments they received. You may have received a letter from CRA regarding CERB payments to be paid back along with one...

TFSA limit for 2021 released

The TFSA new contribution limit for 2021 has been officially released. That limit is $6,000, matching the amount set in 2019 and 2020. With this TFSA dollar limit announcement, the total contribution room available in 2021 for someone who has never contributed and has...

CERB has ended, here is what to know about your benefits

After providing millions of Canadians with financial relief since the beginning of the pandemic, the Canada Emergency Response Benefit (CERB) will be coming to an end on Saturday and recipients will be forced to transition to a recently updated Employment Insurance...

CRA Warning: Pay Your Taxes on the CERB!

The Canada Revenue Agency (CRA) might have helped you through the lockdown if you lost your job due to COVID-19. The federal government initially announced the Canada Emergency Response Benefit (CERB) that would see qualifying Canadians receive $2,000 per month over...