How to Analyze Financial Statements: Vertical Method

As said in previous articles, we have two primary methods to analyze financial statements. Here you will learn how to use both steps by step.

The first method, known as the vertical method, analyzes one fiscal year’s financial information to determine financial statement accounts’ participation in the total of assets, liabilities, and equity in the Balance Sheet or sales in the Profit and Loss statement.

The vertical method uses integral percentages, which means relate each account of the financial statement with a base account valued as 100%.

We assign total assets 100% in the balance sheet and compare it with their accounts’ net values to get each account’s proportion against the full inversion.

Using the same liabilities and equity technique, we compare each account with total liabilities plus equity valued as 100%.

We assign total liabilities and equity 100% to compare with the total liabilities plus equity valued as 100% using the same technique.

On the Profit and Loss statement, total sales, or total income, has a value of 100% and the rest of the accounts use this value as a base percentage for comparison.

To ensure proper analysis, we recommend going through the following steps:

Step #1

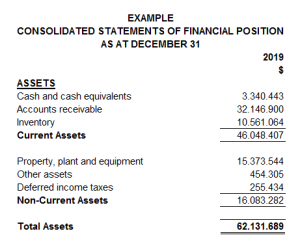

Having the financial statements in an Excel format will be easier to make the necessary calculations. Make sure you include the complete accounts next to their amounts and the year correspondence. In the following example, we can see how it must look.

|

Step #2

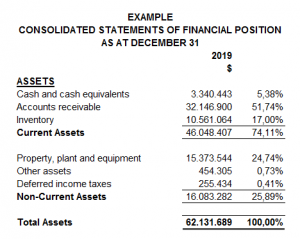

Include a column next to the amounts inserted to be used to present the percentages. The vertical method divides each account’s value between the total assets, liabilities plus equity, or income.

In this example, you can see those basic accounts:

|

Step #3

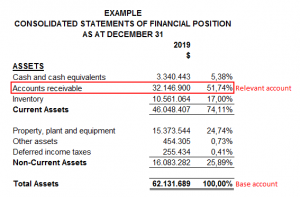

Once you obtained the percentages, you will see on the financial statement how much each account represents and which one is the most or less “important” in terms of inversion.

In this example, accounts receivable have all our attention because it represents more than 50% of the company assets. We chose it because it accounts for more weight, value, or effect in the total assets.

|

Step #4

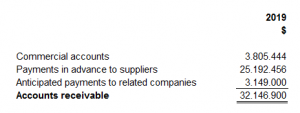

Focusing on one account, we have to investigate by looking into its composition. For example, are those accounts receivable form with debts of the company’s associates or clients? Is the total amount composing of national or foreign currency?

You could get that information by having an interview with the accounting department, the administrator, or even directly by the company’s owner; if audited financial statements are available, you could read it from its notes.

In our example, we can see that accounts receivable are composed of commercials or clients’ accounts, payments in advance to suppliers, and prepaid payments to related parties or companies.

|

Step #5

Finally, we must determine the effect of the account. In this case, our conclusion will be as follow: In 2019, the total assets had a value of 62,131,689, representing 100% of the account, which has 74.11% of current assets and 25.89% of non-current assets. In those percentages, the most valued account is the accounts receivable with 51.74%.

These steps can help us understand that most assets are not liquid. As users of the financial statements, we could investigate when those people will pay the company or compensate with accounts payable and the clients, related companies with debts, etc.

Written by: Andrea Diaz

Related Articles:

Newsletters

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Events & Sponsorship

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Articles & Publications

Hiring outlook improves for 2021

Hiring outlook improves for 2021 One-third of employers reporting labour shortages, up from one-quarter: Survey Employers’ hiring intentions for 2021 have improved compared with earlier in 2020, according to a survey from the Bank of Canada. The percentage of...

Tax Brackets Canada 2021

Federal Tax Bracket Rates for 2021 The following are the federal tax rates for 2021 according to the Canada Revenue Agency (CRA): 15% on the first $49,020 of taxable income, and 20.5% on the portion of taxable income over $49,020 up to $98,040 and 26% on the portion...

RRSP Contribution Limits: How Much Can You Deposit?

RRSP Contribution Limits: How Much Can You Deposit? Contributions to registered retirement savings plans (RRSPs) reduce the amount of income tax you pay, but there are limits on how much you can deposit each year. Registered retirement savings plans (RRSPs) encourage...

Home Office Expenses: New Deduction Methods

Home Office Expenses – New Deduction Methods New Simplified Deduction Methods, New Taxable Benefit Exception, and Employer Obligations On November 30, 2020, Deputy Prime Minister and Minister of Finance Chrystia Freeland released Supporting Canadians and...

What Is Bookkeeping?

To understand the financial health of your business, you need to have precise bookkeeping. Bookkeeping involves verifying receipts, depositing payments into a bank account, and keeping clear records so that all financial information is easily accessible when needed....