Analyzing Financial Statements: The Horizontal Method

The second method to analyze financial statements is the horizontal method. The horizontal method is used to analyze financial information in two fiscal years.

This method consists of comparing various financial statements, and it has a comparative evaluation between two years as less to identify the evolution of different accounts.

The method involves increasing and decreasing, a technique used to compare similar concepts on different dates. The object is to locate differences or inconsistent and analyze the accounts’ behavior year by year.

We determine if the variation is positive (increase) or negative (decrease).

To ensure a good analyze we recommend following the following steps:

Step #1

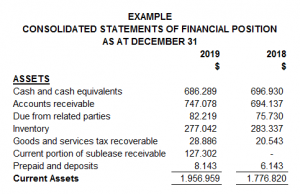

Having the financial statements in an Excel format will make it easier for the necessary calculations. Make sure you include the complete accounts next to their amounts and the two years correspondence. In the following example, we can see how it must look.

|

Step #2

Include two columns next to the amounts inserted; the first one will be used to present the increases and decreases, and the second one will show the percentages.

The horizontal method takes each account’s value from the last year minus each account’s worth from the previous year.

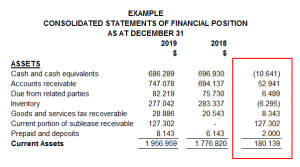

For example, cash and cash equivalents from 2019 minus cash and its equivalents from 2018, as we can see as follow:

|

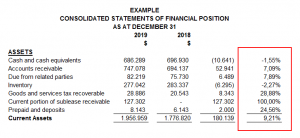

Then, the result is divided by the total of the account from the last year. In this case, the result was divided by the total cash and cash equivalent from 2019 (the most recent year), obtaining 1.55%.

|

Step #3

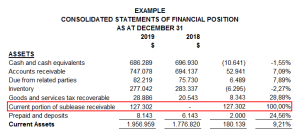

Once the percentages have been obtained, the user of the financial statements can select the account with more variation (a positive percentage if the account had an increase or a negative percentage if the account had a decrease) in the assets, liabilities, or income loss statement.

In the following example, we have the current portion of sublease receivable with 100% positive variation and cash and cash equivalents with 1.55% negative variation. The first have our special attention because it has more than 50%.

|

Step #4

The analyst can start making questions about the variations; the first one could be which sublease did the company celebrate? In which operations or inversions the company expended cash?

You could have that information having an interview with the accounting department, the administrator, or even directly with the company’s owner, also. If the financial statement has been audited, you could read its notes.

With this method and the vertical method, it is essential to be sure about the accounts you are reviewing and investigate a lot about them. Make questions, look for supporting documents and call an expert if necessary.

Written by: Andrea Diaz

Related Articles:

Newsletters

e-Newsletter – June 2018

NewslettersEvents & SponsorshipArticles & Publications

e-Newsletter – May 2018

NewslettersEvents & SponsorshipArticles & Publications

e-Newsletter – April 2018

NewslettersEvents & SponsorshipArticles & Publications

e-Newsletter – March 2018

NewslettersEvents & SponsorshipArticles & Publications

e-Newsletter – February 2018

NewslettersEvents & SponsorshipArticles & Publications

Events & Sponsorship

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Articles & Publications

Is Cryptocurrency Taxable in Canada?

Is cryptocurrency taxable in Canada? According to CRA, possessing or holding a cryptocurrency is not taxable. However, selling, making a gift, trading or exchanging a cryptocurrency, including disposing of one to get another, or converting cryptocurrency to a...

Have Unfiled Tax Returns For Years?

Do You Have Unfiled Tax Returns For Years? As for the record, the CRA wants you to file and pay your taxes on time every year. When you cannot do so, you may put yourself at risk of high penalty amounts and collection tasks like bank levies or wage garnishments. We at...

Old Age Security One-Time Payment Only

Old Age Security One-Time Payment Only. You will receive the one-time payment for older seniors if you were: born on or before June 30, 1947, and eligible for the Old Age Security pension in June 2021 If you have applied for the Old Age Security pension but have not...

CRA Notice of Objection

CRA Notice of Objection (NOO) Once you file your taxes, you receive a Notice of Assessment and later a Notice of Reassessment. You have two options: Pay the taxes owing File a CRA Notice of Objection (NOO). The CRA is not always right; when you disagree, you can...

All You Need to Know About Trust Funds in Canada

All You Need to Know About Trust Funds in Canada A trust is a vehicle for holding and passing on the family property. As such, it typically serves at least one of two purposes: It can reduce a family's taxes by shifting income to members in lower tax brackets, and it...