Fundamentals of Financial Statements Analysis

Financial Statement analysis is carried out through methods, often defined as techniques that allow knowing the entity’s transactions on its financial situation and results.

Based on the order to follow the analysis, these methods simplify and separate the financial statements’ numerical data from measuring the relationships in one period or the changes in several accounting years.

Based on the comparison of values, vertically or horizontally, analysis methods are defined as the Vertical and Horizontal methods.

Vertical Method

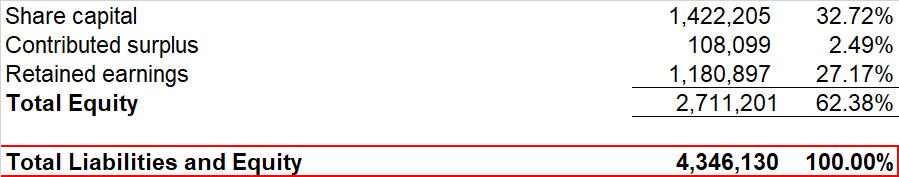

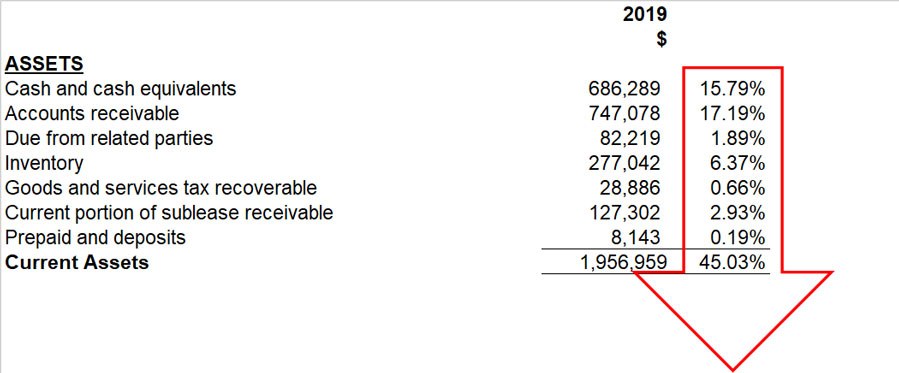

The Vertical method consists of analyzing the financial information of a single year to determine the participation of each account in the Financial Statement regarding total assets or total liabilities and equity, in the case of the Statement of Financial Position, or to the total sales, in the case of the Income Statement.

|

Statement of Financial Position Example |

|

| Income Statement Example |

|

The Vertical method, also called static because it applies to the same year’s financial statement, establishes comparisons between the same items vertically, studies the relationships between a company’s financial elements, and shows how values invested in it are distributed.

|

This method allows to know which items have predominance in the Financial statement understudy, weight the percentage of existing interrelationships between entities, and see the magnitude of importance they have within the financial information.

In the Statement of Financial Position, total assets get the value of 100%, and an account’s net value is compared to establish their proportional magnitude against the total investment. The same applies to liabilities and equities accounts, whose values compared with the total liabilities plus equity has a value of 100%. In an Income Statement, net sales get the value of 100%, and the rest of the accounts is compared against this base percentage.

Thus, this method reduces the amounts of the accounts of the same nature contained in the financial statements to percentages by dividing each one by the general group’s total to which they correspond. This procedure allows determining the weight of a particular account, indicating to the analyst in which accounts weaknesses, deviations, and abnormalities are observed to take corrective measures.

Horizontal Method

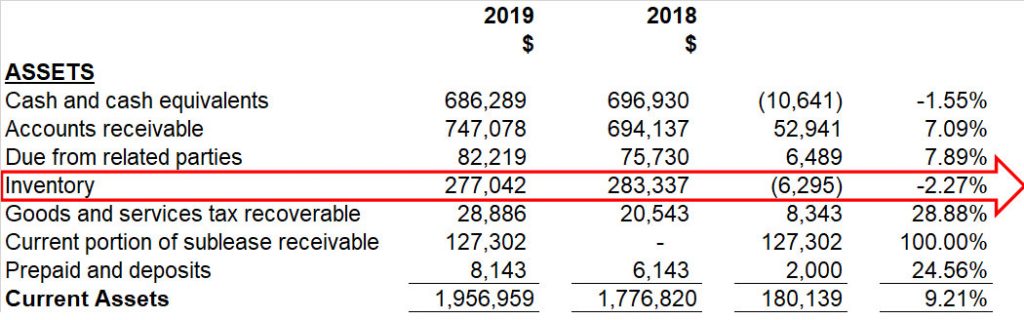

The horizontal method of analizing financial statements consists of comparing several years of financial statements, item by item, in a horizontal correlative manner.

Several successive years are usually studied; generally, at least the last year’s financial statements and the immediately previous year are included. A comparative examination between the two allows identifying the evolution of the different items.

The horizontal method can be understood as a dynamic analysis technique that deals with each account’s changes or movements between one period and another. This method relates the financial modifications suffered by the company, and its represented in increases and decreases, or even percentages, allowing a good view of obtaining the changes.

|

Analyzing increases and decreases consists of comparing homogeneous concepts of financial statements on at least two different dates locating the differences, and analyzing the figures’ behaviors from one period to another. The variation, positively or negatively, from one period to another is determined.

With these methods, business owners, banks, and others interested in understanding the financial statements can identify the variations that have occurred in the accounts in an obvious way and later determine the degree of impact on any company’s economic situation, be it small or medium.

Written by: Andrea Diaz

Related Articles:

Newsletters

Newsletter – February 2020

NewslettersEvents & SponsorshipArticles & Publications

Newsletter – August 2019

NewslettersEvents & SponsorshipArticles & Publications

Newsletter – May 2019

NewslettersEvents & SponsorshipArticles & Publications

Newsletter – April 2019

NewslettersEvents & SponsorshipArticles & Publications

E-Newsletter – February 2019

Events & Sponsorship

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Articles & Publications

December Year-End Readiness Update

December Year End Readiness Update Year-End is almost here! RGB Accounting and ADP want your Year-End to be less stressful and less work. After processing your last payroll for 2021, ADP will automatically run a new Tax Form Trial Run Report. What should you do?...

Do corporate loans count as taxable income?

Do corporate loans count as taxable income? When shareholders or employees borrow money from a corporation, that money is generally considered taxable income. But this rule, like many CRA rules, has exceptions. Many shareholders and employees borrow funds from their...

Beware of using your corporation’s income to pay personal expenses.

Beware of using your corporation's income to pay personal expenses. Suppose you own an incorporated business or professional corporation. In that case, it can be pretty tempting to pay for various personal expenses out of your corporation's income, but doing so is...

How the principal residence rule works

Principal Residence Rules Since 1982, each family unit (including you, your spouse or common-law partner, and any unmarried kids under the age of 18) has been able to designate one property as its principal residence for each calendar year. To simplify the...

Introducing the new Confirm my Representative service

The new Confirm my Representative service. On October 18, 2021, the Canada Revenue Agency (CRA) is introducing a new, two-step verification process to make authorizing a representative using Represent a Client more efficient and secure. The new process makes it easier...