Fundamentals of Financial Statements Analysis

Financial Statement analysis is carried out through methods, often defined as techniques that allow knowing the entity’s transactions on its financial situation and results.

Based on the order to follow the analysis, these methods simplify and separate the financial statements’ numerical data from measuring the relationships in one period or the changes in several accounting years.

Based on the comparison of values, vertically or horizontally, analysis methods are defined as the Vertical and Horizontal methods.

Vertical Method

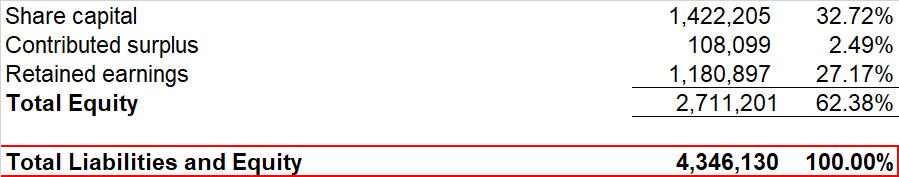

The Vertical method consists of analyzing the financial information of a single year to determine the participation of each account in the Financial Statement regarding total assets or total liabilities and equity, in the case of the Statement of Financial Position, or to the total sales, in the case of the Income Statement.

|

Statement of Financial Position Example |

|

| Income Statement Example |

|

The Vertical method, also called static because it applies to the same year’s financial statement, establishes comparisons between the same items vertically, studies the relationships between a company’s financial elements, and shows how values invested in it are distributed.

|

This method allows to know which items have predominance in the Financial statement understudy, weight the percentage of existing interrelationships between entities, and see the magnitude of importance they have within the financial information.

In the Statement of Financial Position, total assets get the value of 100%, and an account’s net value is compared to establish their proportional magnitude against the total investment. The same applies to liabilities and equities accounts, whose values compared with the total liabilities plus equity has a value of 100%. In an Income Statement, net sales get the value of 100%, and the rest of the accounts is compared against this base percentage.

Thus, this method reduces the amounts of the accounts of the same nature contained in the financial statements to percentages by dividing each one by the general group’s total to which they correspond. This procedure allows determining the weight of a particular account, indicating to the analyst in which accounts weaknesses, deviations, and abnormalities are observed to take corrective measures.

Horizontal Method

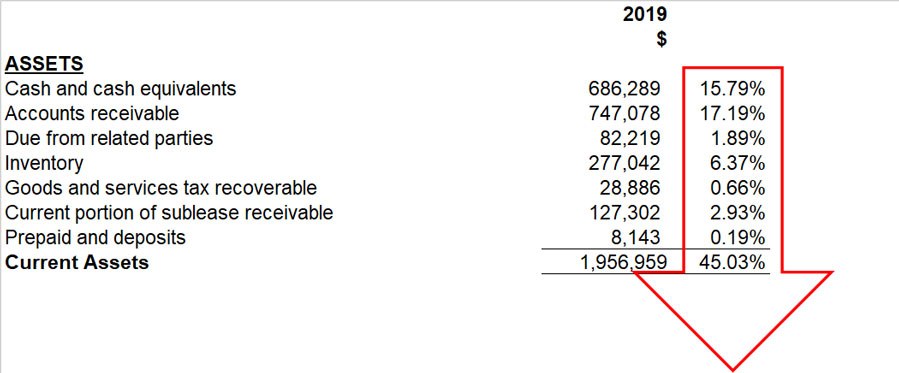

The horizontal method of analizing financial statements consists of comparing several years of financial statements, item by item, in a horizontal correlative manner.

Several successive years are usually studied; generally, at least the last year’s financial statements and the immediately previous year are included. A comparative examination between the two allows identifying the evolution of the different items.

The horizontal method can be understood as a dynamic analysis technique that deals with each account’s changes or movements between one period and another. This method relates the financial modifications suffered by the company, and its represented in increases and decreases, or even percentages, allowing a good view of obtaining the changes.

|

Analyzing increases and decreases consists of comparing homogeneous concepts of financial statements on at least two different dates locating the differences, and analyzing the figures’ behaviors from one period to another. The variation, positively or negatively, from one period to another is determined.

With these methods, business owners, banks, and others interested in understanding the financial statements can identify the variations that have occurred in the accounts in an obvious way and later determine the degree of impact on any company’s economic situation, be it small or medium.

Written by: Andrea Diaz

Related Articles:

Newsletters

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Events & Sponsorship

Talent Kids Event 2017

August 19, 2017 RGB Accounting has proudly sponsored the 2017 Talent Kids event organized by Pecora Events on August 19th. RGB Accounting wants to thank organizers, presenters, judges, and all participants for making this a great event. Here we share some of the...

Los Nocheros USA/Canada Tour 2017

June 02, 2017 Argentina's biggest folkloric phenomenon arrived in Toronto, Canada to celebrate its 30 years trajectory. RGB Accounting was one of the sponsors of the event. More from our blog Newsletters Events & Sponsorship Articles &...

2nd Latin American Entrepreneur Conference

May 29, 2017 The Entrepreneur Conference was organized by the City of Toronto's Economic Development & Culture department in partnership with the Latin American Bi-Lateral Trade Initiative (LABTI) which consists of the Consulate Generals of Argentina, Brazil,...

Tax Season 2017 at La Liga Indoor Soccer

April 29, 2017 RGB Accounting has been sponsoring social events to promote cultural values in the hispanic community of Toronto and the GTA. The During the last tax season, RGB Accounting helped many individuals and small business owners to prepare their taxes,...

Articles & Publications

The Ultimate Bookkeeping Checklist for Canadian Small Businesses (CRA-Compliant)

The Ultimate Bookkeeping Checklist for Canadian Small Businesses (CRA-Compliant) Keeping accurate financial records isn’t just good practice—it’s a legal requirement under the Canada Revenue Agency (CRA). Whether you’re a solo entrepreneur, a growing small business,...

The Surprising Medical Expenses You Can Claim with the CRA!

The Surprising Medical Expenses You Can Claim with the CRA! In the realm of medical expenses, which are often deemed both essential and financially burdensome, the Canada Revenue Agency (CRA) emerges as a potential source of relief for Canadians. While the CRA...

Shareholder Owners Salaries vs Dividends

NewslettersEvents & SponsorshipArticles & Publications

Understanding the Shareholder Loan

Understanding the Shareholder Loan. How to Use it to your Advantage and Stay Compliant with CRA If you are the owner-manager of a corporation, understanding the concept of the shareholder loan is essential to running your business. Below I will explain what a...

GST/HST for digital economy businesses

GST/HST for digital economy businesses Overview New rules for digital economy businesses are in effect as of July 1, 2021. As of July 1, 2021, digital economy businesses, including digital platform operators, may have potential goods and services tax/harmonized sales...