Accounting Methods: Which One is Best for Your Business?

Every small business owner needs to decide which accounting method is best for their business. We’ll explain each method and help you decide which one you should use.

There are different types of accounting. There are also other accounting methods, with the cash method and the accrual method used most frequently. When setting up bookkeeping for your small business, you’ll need to choose which one to use.

Overview: What is an accounting method?

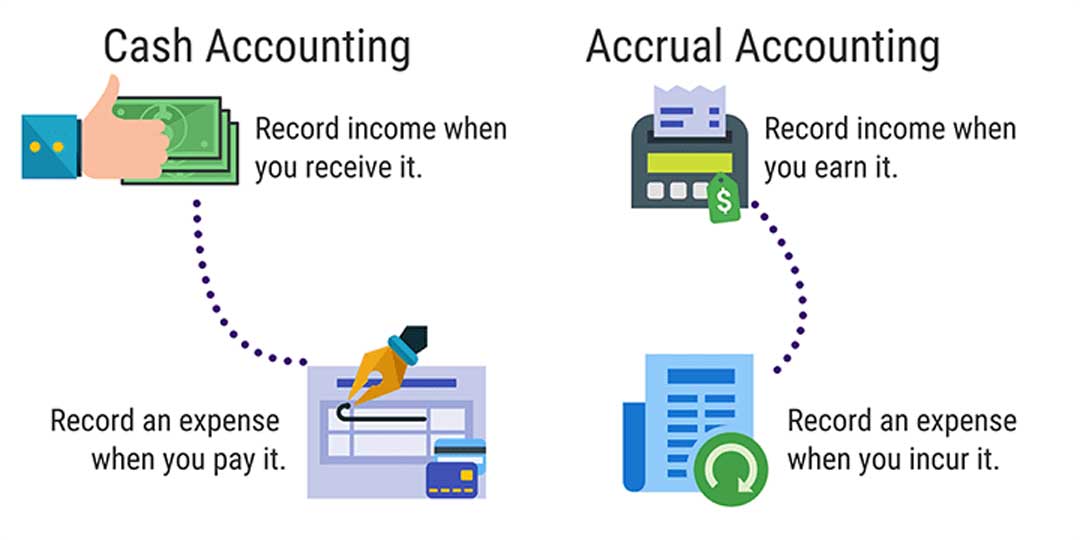

An accounting method is based on rules that a company must follow when reporting both revenues and expenses. The two main accounting methods, cash and accrual, are similar in some ways but vary widely in others.

You can also use a hybrid method for small business owners with limited accounting experience; however, it is not recommended. Once you choose an accounting method, you need to continue to use that method until the end of your fiscal year, where you can change to a different method if you prefer.

What to consider when choosing accounting methods

Whether you choose the cash method or the accrual method of accounting, you can still keep track of your operating expenses and manage basic business expenses. You can even create a budget using either method. Here are some additional factors to consider when deciding between these different accounting methods:

- The current size of your business

If you’re a freelancer or sole proprietor, your bookkeeping needs are very different from the needs of a growing business. Keep that in mind when choosing an accounting method for your business.

- Plans for the future

Your business may be small now, but do your plans include growth and expansion? If so, it may better serve you by choosing an accounting method that is suited to what you want your business to become, rather than the size it is right now. Hiring employees can also impact the choice you make.

- The legal structure of your business

If your business is a C corporation or earns more than $25 million in gross revenue annually, you must use accrual accounting. Of course, if you’re making millions of dollars in revenue, likely, you’re not a small business. Any publicly-traded company must also use the accrual accounting method.

- Do you want to bring investors into the business?

Running a one-person business gives you the freedom to choose the accounting method that you’re most comfortable with. However, if part of your growth strategy is to bring in investors or apply for a bank loan, you need to choose the accounting method that they would be most comfortable with.

How to choose the correct accounting method for your small business

The size of your business plays a significant role in determining which accounting method you ultimately choose. However, if you want to have a more accurate balance sheet, track retained earnings, or better manage your business expenses proactively, you’ll need to use the accrual method.

Method 1: Cash

The cash method recognizes revenue when cash is received and when you paid the expenses. In other words, when you receive a bill from a vendor that is due next month, that expense is not recognized until it is delivered.

The cash method is typically used by small businesses simply because it’s easier and doesn’t require tracking accounts receivable and accounts payable. The cash method also eliminates the need for journal entries.

Another distinct advantage of using the cash method is easier tracking of cash flow since you’ll always know how much cash you have at any given time.

When to use the cash method

The cash method is the easiest method to use when just starting. The cash method can also benefit those with limited cash on hand, as taxes would be due to revenue when received, not when services are rendered.

- If you’re a freelancer: If you’re a freelancer, your accounting needs will mainly focus on invoicing your clients and getting paid. Cash accounting can handle that easily, and you won’t have to pay taxes on income until it’s received — an essential component if you have slow-paying clients.

- If you’re a new business owner: New business owners and sole proprietors often find that starting with cash accounting is much easier than accrual accounting. Reporting needs are fewer, you do not need to manage your general ledger with numerous adjustments, and you’ll always have a good idea of what your cash totals are.

Method 2: Accrual

The accrual method of accounting is more complex than its cash counterpart. Accrual accounting is also the method recommended by CPAs and other accounting professionals.

Unlike the cash method, the accrual method of accounting requires you to record your revenues and expenses when they are earned, not when they are received or paid. One of the main advantages of accrual accounting is that it provides a more realistic view of your business income and expenses.

There are a few downsides to accrual accounting. You can better track cash flow using the cash accounting method, and you’ll need to pay taxes on income that you may not have yet received, which can be potentially disastrous for smaller businesses with limited cash flow.

When to use the accrual method

Your once-small business now has five employees and a newly rented office space. You’re starting to look for potential investors or perhaps apply for bank financing. Now is the time to make a move to accrual accounting.

- When you want to expand: The cash method is by far the best method for small businesses, but even small businesses can benefit from using the accrual accounting method, particularly when you want to bring on employees, seek investors, or obtain a bank financing.

- When you bill your customers: While retailers may find the cash method more helpful if you frequently bill your clients for your services, it’s best to use accrual accounting. Utilizing the accrual accounting method allows you to record your revenue at the time of service, not when your client pays, providing you with a much more accurate financial picture.

If your business currently stocks inventory, you can also choose to use a hybrid accounting method, which combines the cash method to track income and expenses and uses the accrual method to track inventory. However, the hybrid method can be confusing, particularly for small business owners with limited accounting or bookkeeping experience.

The best accounting software for your small business

The best way to keep track of your business is to use accounting software, particularly for companies looking to use accrual accounting.

1. FreshBooks

FreshBooks is the perfect option for those making the transition from spreadsheet accounting or moving to accrual accounting for the first time. Best suited for sole proprietors or smaller businesses, FreshBooks offers easy product setup, so you can be up and running in no time.

FreshBooks is a good fit for sole proprietors, freelancers, and small teams.

An excellent fit for smaller businesses that need to invoice customers, FreshBooks offers the following features:

- Quick, custom invoicing: Creating a professional-looking invoice in FreshBooks takes about a minute, with the application offering several customization options. Once you create an invoice, you can also set a reminder in FreshBooks to notify you when payment is late.

- Time tracking: Another excellent feature for sole proprietors, freelancers, and smaller businesses is the time-tracking capability found in FreshBooks. You can log your hours at any time or use the time-tracking mobile app to track time from any location.

- Client estimates and proposals: Just because you may work solo doesn’t mean you can’t create top-notch proposals for your clients. FreshBooks allows you to create a formal proposal or a quick estimate, depending on your needs.

- Telephone support: This feature is rare in entry-level accounting applications, but FreshBooks offers telephone support, along with email and chat support options as well.

FreshBooks offers four plans: Lite, Plus, Premium, and Select, with customizable invoices, online and credit card payment acceptance, dashboards, and estimates included in all scenarios. Plan pricing is based on the number of clients, not the number of users.

- Lite plan: $6/month for five billable clients

- Plus: $10/month for 50 billable clients

- Premium: $20/month for 500 billable clients

- Select: Pricing available upon request for 500+ billable clients

- Sage 50cloud Accounting

2. Sage 50cloud Accounting

If you’re looking to make a move up to more robust accounting software, Sage 50cloud Accounting may be a good choice. Suitable for both small and growing businesses, Sage 50cloud Accounting offers a unique hybrid structure that combines on-premise stability with the convenience of cloud accessibility.

Sage 50cloud Accounting offers easy navigation from the user dashboard.

Here are just a few of the features you’ll find in Sage 50cloud Accounting:

- Automated bank feeds: You can choose to connect Sage 50cloud Accounting to your banking institution for automatic bank feeds or use it to reconcile your bank accounts at month’s end.

- Customer and sales: Sage 50cloud Accounting offers excellent customer management capabilities, so you can assign payment terms and credit limits and provide specific customers with discounts. You can also create custom invoices, record customer payments, and even accept payments online.

- Inventory: A real plus for any business that sells products, Sage 50cloud Accounting offers excellent inventory tracking, supports multiple pricing levels, and even supports assemblies in the Premium and Quantum plans.

- Solid reporting: Sage 50cloud Accounting offers an excellent selection of standard reporting options such as net profit and net income, with all reports easily customizable. All information can be exported to Microsoft Excel for further customization if desired.

Sage 50cloud Accounting currently runs $278.95/year for a single-user system, with the Premium plan running $431.95/year, which supports up to five users. For businesses with more than five users, check out the Quantum plan, with pricing available upon request.

3. AccountEdge Pro

If you’re looking for powerful accounting capability, look no further than AccountEdge Pro. Well suited for growing businesses that have outgrown entry-level applications, AccountEdge Pro offers both on-premise and cloud deployment options, as well as an enterprise-level application for larger firms.

AccountEdge Pro includes an intuitive user interface for easy system navigation.

Here are some of the features you can find in AccountEdge Pro:

- Multiple charts of accounts templates: AccountEdge Pro includes 100 charts of accounts templates with the application, which you can customize as needed.

- Time billing: One of the features not frequently found in small business accounting applications is time billing. AccountEdge Pro allows you to track billable and non-billable hours, track employee time spent at a client’s office or on a project, and manage work in progress for larger projects.

- Payroll: Instead of integrating with outside payroll services, AccountEdge Pro offers a payroll module in the application.

- Customer portal: The customer portal is a nice touch and necessary for businesses that appreciate being paid promptly.

AccountEdge Pro pricing is $399 for a single user, with each additional user running $249 each. These are one-time fees paid when purchasing AccountEdge Pro for the first time. Those looking for cloud accessibility will want to look at Priority Zoom, which supports up to five users at the cost of $50/month.

Whatever method of accounting you choose, managing your business will be much easier with accounting software. Be sure to check out The Blueprint’s accounting software reviews to find an application that will work for your business.

Cash or accrual: which is best for your business?

An essential part of being a business owner is determining the accounting method that is best suited for your business. Freelancers and sole proprietors will likely benefit the most from using the cash accounting method. Still, if your business is growing or you wish to add investors or apply for a bank loan, you’ll be better served using the accrual accounting method.

Source: fool.com

Newsletters

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Events & Sponsorship

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Articles & Publications

Changes to RRSP and CPP in 2021

The Canada Revenue Agency (CRA) has made annual announcements about the nation’s retirement programs. Namely, the Canada Pension Plan (CPP) and the Registered Retirement Savings Plan (RRSP) are being updated as we enter the new year. Here are the changes you need to...

CRA Collection Letters for CERB Ineligibility & Repayment

The Canada Revenue Agency has begun issuing formal collection letters for CERB repayment to recipients who may or may not have been eligible for the payments they received. You may have received a letter from CRA regarding CERB payments to be paid back along with one...

TFSA limit for 2021 released

The TFSA new contribution limit for 2021 has been officially released. That limit is $6,000, matching the amount set in 2019 and 2020. With this TFSA dollar limit announcement, the total contribution room available in 2021 for someone who has never contributed and has...

CERB has ended, here is what to know about your benefits

After providing millions of Canadians with financial relief since the beginning of the pandemic, the Canada Emergency Response Benefit (CERB) will be coming to an end on Saturday and recipients will be forced to transition to a recently updated Employment Insurance...

CRA Warning: Pay Your Taxes on the CERB!

The Canada Revenue Agency (CRA) might have helped you through the lockdown if you lost your job due to COVID-19. The federal government initially announced the Canada Emergency Response Benefit (CERB) that would see qualifying Canadians receive $2,000 per month over...