Canadians will have extra time to file and pay income taxes to the Canada Revenue Agency, as the federal government looks to provide financial support for people and businesses in the midst of the coronavirus crisis.

Prime Minister Justin Trudeau unveiled an $82 billion support package on Wednesday that will provide $27 billion in direct funding, while $55 billion will be dedicated to tax deferrals for both businesses and individuals.

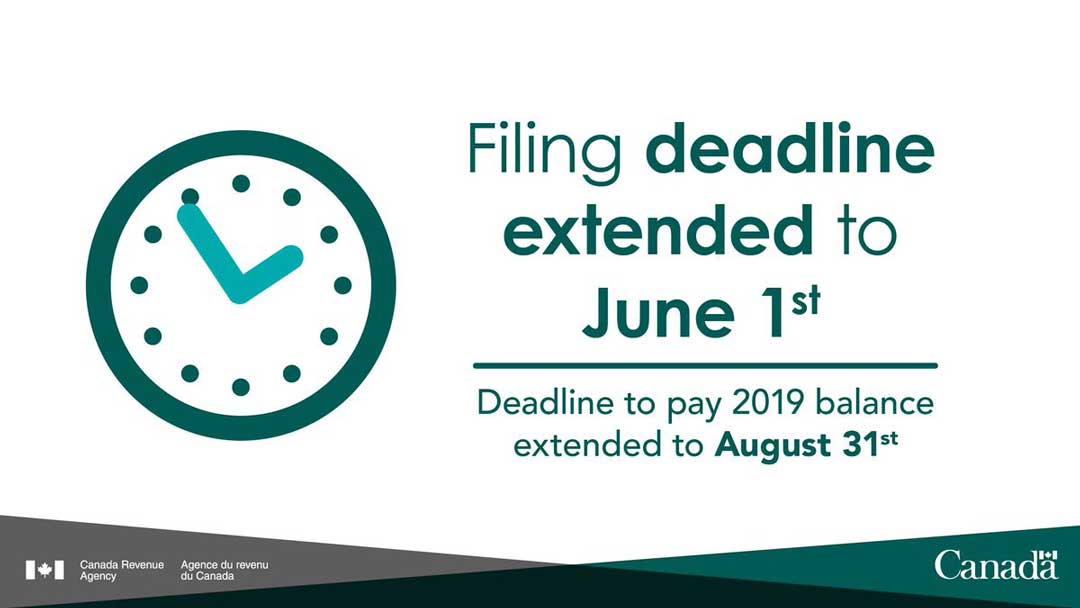

The deadline for individuals to file taxes has been extended from April 30 to June 1, giving people an extra month to file their returns to the CRA. The deadline to pay any income tax owed to the government will also be extended, allowing Canadians to pay it off without interest or penalties until Aug. 31.

However, the government is still encouraging people who receive benefits under the Goods and Services Tax and the Canada Child Benefit act to file returns as soon as possible to ensure their future benefits “are properly determined.” The CRA will also temporarily recognize electronic signatures as adequate when it comes to filing taxes.

“We want to make very sure that people have access to financial resources in a time of real need,” Finance Minister Bill Morneau said at a press conference on Wednesday.

“We know that people are concerned about having access to enough money for essentials, for medicine, for healthcare, for any form of food or lodging. These are critically important and so we focused our approach on having enough money delivered at the right time so people can actually deal with the issues that they are facing.”

Aaron Wudrick, federal director with the Canadian Taxpayers Federation, commended the government for pushing back the filing deadline and allowing tax deferment as a way to mitigate the economic fallout.

“It’s a recognition that tax represents a significant burden for a lot of people and businesses, and giving tax relief is also a lot simpler than trying to sort out new mechanisms to transfer money,” Wudrick said.

“Obviously it won’t cover every situation but it’s a key thing to include in any rescue package.”

All businesses will also be able to defer payments of any income tax amounts owed to the government until Aug. 31. No interest or penalties will accumulate during this time.

When it comes to small and medium businesses, the CRA said it will not initiate any post assessment GST, HST or income tax audits for the next four weeks.

“For the vast majority of businesses, the Canada Revenue Agency will temporarily suspend audit interaction with taxpayers and representatives,” the government said.

Source: Yahoo Finance

Newsletters

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Events & Sponsorship

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Articles & Publications

Reporting income from Airbnb

Reporting Income from Airbnb Like other, more traditional, rentals, the Canada Revenue Agency (CRA) has specific rules surrounding the declaring of rental income, which you should become familiar with as soon as possible. What you need to know about earning income...

What is Income Splitting?

What is Income Splitting? By definition, income splitting involves diverting dividend income (and certain other types of income) from one family member to another member in a lower tax bracket resulting in substantial tax savings. By way of example, let’s take the...

Real Estate Tax Update

Real Estate tax update Canada Revenue Agency (CRA) has taken substantial changes to control real estate transactions. In recent years, CRA has increased its real estate audits, particularly in the Greater Vancouver and the Greater Toronto areas, where increased real...

Snowbirds

Snowbirds, March 1, 2019 The age-old Canadian tradition for retirees: when it starts getting cold outside, Canadians will “flock” to the warmer shores of the United States. Are there any tax considerations in the United States we need to be aware of when your retired...

Beware of scammers posing as CRA employees

Beware of scammers posing as CRA employees. Scammers posing as Canada Revenue Agency (CRA) employees continue to contact Canadians, misleading them into paying the false debt. These persistent scammers have created fear among people who now automatically assume that...