Analyzing Financial Statements: The Horizontal Method

The second method to analyze financial statements is the horizontal method. The horizontal method is used to analyze financial information in two fiscal years.

This method consists of comparing various financial statements, and it has a comparative evaluation between two years as less to identify the evolution of different accounts.

The method involves increasing and decreasing, a technique used to compare similar concepts on different dates. The object is to locate differences or inconsistent and analyze the accounts’ behavior year by year.

We determine if the variation is positive (increase) or negative (decrease).

To ensure a good analyze we recommend following the following steps:

Step #1

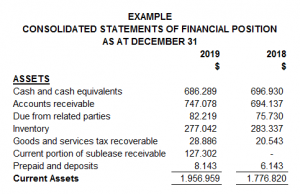

Having the financial statements in an Excel format will make it easier for the necessary calculations. Make sure you include the complete accounts next to their amounts and the two years correspondence. In the following example, we can see how it must look.

|

Step #2

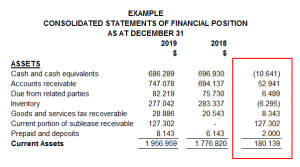

Include two columns next to the amounts inserted; the first one will be used to present the increases and decreases, and the second one will show the percentages.

The horizontal method takes each account’s value from the last year minus each account’s worth from the previous year.

For example, cash and cash equivalents from 2019 minus cash and its equivalents from 2018, as we can see as follow:

|

Then, the result is divided by the total of the account from the last year. In this case, the result was divided by the total cash and cash equivalent from 2019 (the most recent year), obtaining 1.55%.

|

Step #3

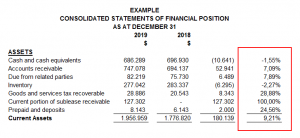

Once the percentages have been obtained, the user of the financial statements can select the account with more variation (a positive percentage if the account had an increase or a negative percentage if the account had a decrease) in the assets, liabilities, or income loss statement.

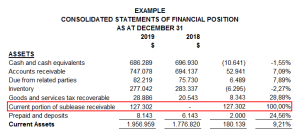

In the following example, we have the current portion of sublease receivable with 100% positive variation and cash and cash equivalents with 1.55% negative variation. The first have our special attention because it has more than 50%.

|

Step #4

The analyst can start making questions about the variations; the first one could be which sublease did the company celebrate? In which operations or inversions the company expended cash?

You could have that information having an interview with the accounting department, the administrator, or even directly with the company’s owner, also. If the financial statement has been audited, you could read its notes.

With this method and the vertical method, it is essential to be sure about the accounts you are reviewing and investigate a lot about them. Make questions, look for supporting documents and call an expert if necessary.

Written by: Andrea Diaz

Related Articles:

Newsletters

e-Newsletter – January 2018

NewslettersEvents & SponsorshipArticles & Publications

Events & Sponsorship

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Articles & Publications

Non-Resident Canadian Tax Clearance Certificates

People who are not Canadian Residents for Tax Purposes may be subject to a withholding tax when they sell Canadian property. All non-resident Canadian for tax purposes may be subject to this withholding tax if they sell real estate in Canada. This holds if they own...

Moving to the U.S. for more affordable Real Estate

Moving to the U.S. for more affordable Real Estate? Home prices have run-up in the U.S. but are mostly more affordable than major Canadian markets. Like many real estate markets worldwide, U.S. home prices have run up during the pandemic to the point of some saying...

New Goods and Services/Harmonized Sales Tax Rules

This article intends to illustrate how the new proposed Goods and Services/Harmonized Sales Tax (GST/HST) rules are to apply to the sale of goods made on July 1, 2021, or later, by a retailer that is a non-resident of Canada and not registered for GST/HST purposes,...

When withdrawing funds early from your RRSP makes sense

Most Canadians spend their working lives socking away as much money as they can in their registered retirement savings plans (RRSPs) — often feeling guilty if they’re not maxing out the contribution limits set by the federal government. Once retirement rolls around,...

Understanding the CRA Notice of Assessment

Understanding the CRA Notice of Assessment How to object if you think the CRA is wrong Most of us have received our Notice of Assessment from the CRA for our 2020 tax returns. Mostly it is pretty much as you expected – a refund or no balance owing. But sometimes, the...