Analyzing Financial Statements: The Horizontal Method

The second method to analyze financial statements is the horizontal method. The horizontal method is used to analyze financial information in two fiscal years.

This method consists of comparing various financial statements, and it has a comparative evaluation between two years as less to identify the evolution of different accounts.

The method involves increasing and decreasing, a technique used to compare similar concepts on different dates. The object is to locate differences or inconsistent and analyze the accounts’ behavior year by year.

We determine if the variation is positive (increase) or negative (decrease).

To ensure a good analyze we recommend following the following steps:

Step #1

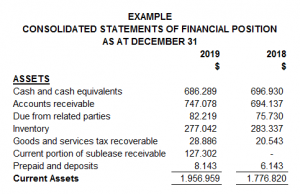

Having the financial statements in an Excel format will make it easier for the necessary calculations. Make sure you include the complete accounts next to their amounts and the two years correspondence. In the following example, we can see how it must look.

|

Step #2

Include two columns next to the amounts inserted; the first one will be used to present the increases and decreases, and the second one will show the percentages.

The horizontal method takes each account’s value from the last year minus each account’s worth from the previous year.

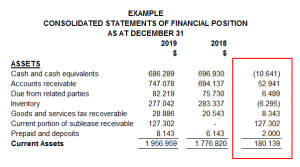

For example, cash and cash equivalents from 2019 minus cash and its equivalents from 2018, as we can see as follow:

|

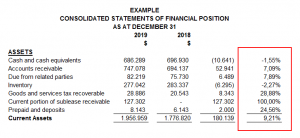

Then, the result is divided by the total of the account from the last year. In this case, the result was divided by the total cash and cash equivalent from 2019 (the most recent year), obtaining 1.55%.

|

Step #3

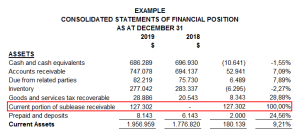

Once the percentages have been obtained, the user of the financial statements can select the account with more variation (a positive percentage if the account had an increase or a negative percentage if the account had a decrease) in the assets, liabilities, or income loss statement.

In the following example, we have the current portion of sublease receivable with 100% positive variation and cash and cash equivalents with 1.55% negative variation. The first have our special attention because it has more than 50%.

|

Step #4

The analyst can start making questions about the variations; the first one could be which sublease did the company celebrate? In which operations or inversions the company expended cash?

You could have that information having an interview with the accounting department, the administrator, or even directly with the company’s owner, also. If the financial statement has been audited, you could read its notes.

With this method and the vertical method, it is essential to be sure about the accounts you are reviewing and investigate a lot about them. Make questions, look for supporting documents and call an expert if necessary.

Written by: Andrea Diaz

Related Articles:

Newsletters

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Events & Sponsorship

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Articles & Publications

Reporting income from Airbnb

Reporting Income from Airbnb Like other, more traditional, rentals, the Canada Revenue Agency (CRA) has specific rules surrounding the declaring of rental income, which you should become familiar with as soon as possible. What you need to know about earning income...

What is Income Splitting?

What is Income Splitting? By definition, income splitting involves diverting dividend income (and certain other types of income) from one family member to another member in a lower tax bracket resulting in substantial tax savings. By way of example, let’s take the...

Real Estate Tax Update

Real Estate tax update Canada Revenue Agency (CRA) has taken substantial changes to control real estate transactions. In recent years, CRA has increased its real estate audits, particularly in the Greater Vancouver and the Greater Toronto areas, where increased real...

Snowbirds

Snowbirds, March 1, 2019 The age-old Canadian tradition for retirees: when it starts getting cold outside, Canadians will “flock” to the warmer shores of the United States. Are there any tax considerations in the United States we need to be aware of when your retired...

Beware of scammers posing as CRA employees

Beware of scammers posing as CRA employees. Scammers posing as Canada Revenue Agency (CRA) employees continue to contact Canadians, misleading them into paying the false debt. These persistent scammers have created fear among people who now automatically assume that...