Analyzing Financial Statements: The Horizontal Method

The second method to analyze financial statements is the horizontal method. The horizontal method is used to analyze financial information in two fiscal years.

This method consists of comparing various financial statements, and it has a comparative evaluation between two years as less to identify the evolution of different accounts.

The method involves increasing and decreasing, a technique used to compare similar concepts on different dates. The object is to locate differences or inconsistent and analyze the accounts’ behavior year by year.

We determine if the variation is positive (increase) or negative (decrease).

To ensure a good analyze we recommend following the following steps:

Step #1

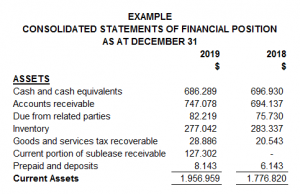

Having the financial statements in an Excel format will make it easier for the necessary calculations. Make sure you include the complete accounts next to their amounts and the two years correspondence. In the following example, we can see how it must look.

|

Step #2

Include two columns next to the amounts inserted; the first one will be used to present the increases and decreases, and the second one will show the percentages.

The horizontal method takes each account’s value from the last year minus each account’s worth from the previous year.

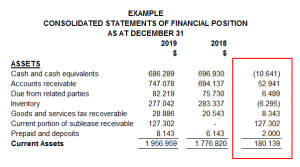

For example, cash and cash equivalents from 2019 minus cash and its equivalents from 2018, as we can see as follow:

|

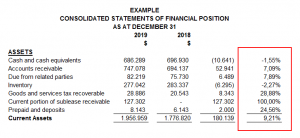

Then, the result is divided by the total of the account from the last year. In this case, the result was divided by the total cash and cash equivalent from 2019 (the most recent year), obtaining 1.55%.

|

Step #3

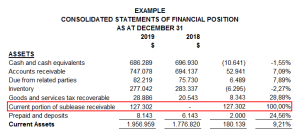

Once the percentages have been obtained, the user of the financial statements can select the account with more variation (a positive percentage if the account had an increase or a negative percentage if the account had a decrease) in the assets, liabilities, or income loss statement.

In the following example, we have the current portion of sublease receivable with 100% positive variation and cash and cash equivalents with 1.55% negative variation. The first have our special attention because it has more than 50%.

|

Step #4

The analyst can start making questions about the variations; the first one could be which sublease did the company celebrate? In which operations or inversions the company expended cash?

You could have that information having an interview with the accounting department, the administrator, or even directly with the company’s owner, also. If the financial statement has been audited, you could read its notes.

With this method and the vertical method, it is essential to be sure about the accounts you are reviewing and investigate a lot about them. Make questions, look for supporting documents and call an expert if necessary.

Written by: Andrea Diaz

Related Articles:

Newsletters

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Events & Sponsorship

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Articles & Publications

Changes to RRSP and CPP in 2021

The Canada Revenue Agency (CRA) has made annual announcements about the nation’s retirement programs. Namely, the Canada Pension Plan (CPP) and the Registered Retirement Savings Plan (RRSP) are being updated as we enter the new year. Here are the changes you need to...

CRA Collection Letters for CERB Ineligibility & Repayment

The Canada Revenue Agency has begun issuing formal collection letters for CERB repayment to recipients who may or may not have been eligible for the payments they received. You may have received a letter from CRA regarding CERB payments to be paid back along with one...

TFSA limit for 2021 released

The TFSA new contribution limit for 2021 has been officially released. That limit is $6,000, matching the amount set in 2019 and 2020. With this TFSA dollar limit announcement, the total contribution room available in 2021 for someone who has never contributed and has...

CERB has ended, here is what to know about your benefits

After providing millions of Canadians with financial relief since the beginning of the pandemic, the Canada Emergency Response Benefit (CERB) will be coming to an end on Saturday and recipients will be forced to transition to a recently updated Employment Insurance...

CRA Warning: Pay Your Taxes on the CERB!

The Canada Revenue Agency (CRA) might have helped you through the lockdown if you lost your job due to COVID-19. The federal government initially announced the Canada Emergency Response Benefit (CERB) that would see qualifying Canadians receive $2,000 per month over...