Analyzing Financial Statements: The Horizontal Method

The second method to analyze financial statements is the horizontal method. The horizontal method is used to analyze financial information in two fiscal years.

This method consists of comparing various financial statements, and it has a comparative evaluation between two years as less to identify the evolution of different accounts.

The method involves increasing and decreasing, a technique used to compare similar concepts on different dates. The object is to locate differences or inconsistent and analyze the accounts’ behavior year by year.

We determine if the variation is positive (increase) or negative (decrease).

To ensure a good analyze we recommend following the following steps:

Step #1

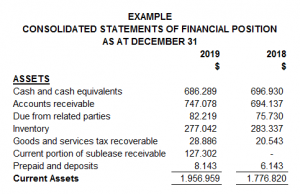

Having the financial statements in an Excel format will make it easier for the necessary calculations. Make sure you include the complete accounts next to their amounts and the two years correspondence. In the following example, we can see how it must look.

|

Step #2

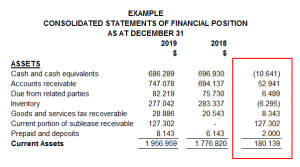

Include two columns next to the amounts inserted; the first one will be used to present the increases and decreases, and the second one will show the percentages.

The horizontal method takes each account’s value from the last year minus each account’s worth from the previous year.

For example, cash and cash equivalents from 2019 minus cash and its equivalents from 2018, as we can see as follow:

|

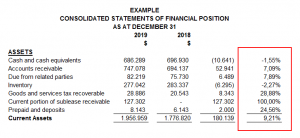

Then, the result is divided by the total of the account from the last year. In this case, the result was divided by the total cash and cash equivalent from 2019 (the most recent year), obtaining 1.55%.

|

Step #3

Once the percentages have been obtained, the user of the financial statements can select the account with more variation (a positive percentage if the account had an increase or a negative percentage if the account had a decrease) in the assets, liabilities, or income loss statement.

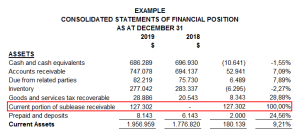

In the following example, we have the current portion of sublease receivable with 100% positive variation and cash and cash equivalents with 1.55% negative variation. The first have our special attention because it has more than 50%.

|

Step #4

The analyst can start making questions about the variations; the first one could be which sublease did the company celebrate? In which operations or inversions the company expended cash?

You could have that information having an interview with the accounting department, the administrator, or even directly with the company’s owner, also. If the financial statement has been audited, you could read its notes.

With this method and the vertical method, it is essential to be sure about the accounts you are reviewing and investigate a lot about them. Make questions, look for supporting documents and call an expert if necessary.

Written by: Andrea Diaz

Related Articles:

Newsletters

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Events & Sponsorship

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Articles & Publications

Everything you need to know about your 2020 taxes.

As tax season begins, Canadians are faced with filing for an unprecedented year - job losses, federal financial aid, and working from home are just some of the major adjustments made over 2020. The Canada Revenue Agency (CRA) has listed all the deadlines for the 2020...

Which Accounting Method is Best for Your Business?

Accounting Methods: Which One is Best for Your Business? Every small business owner needs to decide which accounting method is best for their business. We'll explain each method and help you decide which one you should use. There are different types of accounting....

Award-Winning ADP Next Gen Payroll Platform Expands to Canada and Mexico

Market-leading cloud platform available across North America ADP is expanding its leading Next Gen Payroll Platform across North America to Canada and Mexico to help transform the payroll experience for both practitioners and employees in those markets. With...

ADP Canada National Employment Report

Employment in Canada Decreased by 28,800 Jobs in December 2020 Employment in Canada decreased by 28,800 jobs from November to December according to the December ADP® Canada National Employment Report. Broadly distributed to the public each month, free of...

Canada Emergency Rent Subsidy (CERS)

Canada Emergency Rent Subsidy (CERS) Canadian businesses, non-profit organizations, or charities who have seen a drop in revenue due to the COVID-19 pandemic may be eligible for the Canada Emergency Rent Subsidy (CERS) to cover part of their commercial rent or...