Analyzing Financial Statements: The Horizontal Method

The second method to analyze financial statements is the horizontal method. The horizontal method is used to analyze financial information in two fiscal years.

This method consists of comparing various financial statements, and it has a comparative evaluation between two years as less to identify the evolution of different accounts.

The method involves increasing and decreasing, a technique used to compare similar concepts on different dates. The object is to locate differences or inconsistent and analyze the accounts’ behavior year by year.

We determine if the variation is positive (increase) or negative (decrease).

To ensure a good analyze we recommend following the following steps:

Step #1

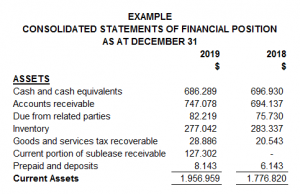

Having the financial statements in an Excel format will make it easier for the necessary calculations. Make sure you include the complete accounts next to their amounts and the two years correspondence. In the following example, we can see how it must look.

|

Step #2

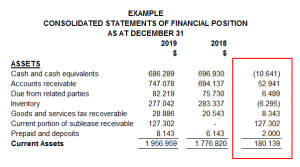

Include two columns next to the amounts inserted; the first one will be used to present the increases and decreases, and the second one will show the percentages.

The horizontal method takes each account’s value from the last year minus each account’s worth from the previous year.

For example, cash and cash equivalents from 2019 minus cash and its equivalents from 2018, as we can see as follow:

|

Then, the result is divided by the total of the account from the last year. In this case, the result was divided by the total cash and cash equivalent from 2019 (the most recent year), obtaining 1.55%.

|

Step #3

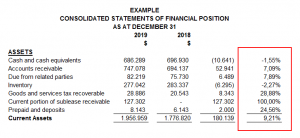

Once the percentages have been obtained, the user of the financial statements can select the account with more variation (a positive percentage if the account had an increase or a negative percentage if the account had a decrease) in the assets, liabilities, or income loss statement.

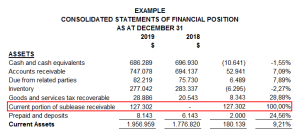

In the following example, we have the current portion of sublease receivable with 100% positive variation and cash and cash equivalents with 1.55% negative variation. The first have our special attention because it has more than 50%.

|

Step #4

The analyst can start making questions about the variations; the first one could be which sublease did the company celebrate? In which operations or inversions the company expended cash?

You could have that information having an interview with the accounting department, the administrator, or even directly with the company’s owner, also. If the financial statement has been audited, you could read its notes.

With this method and the vertical method, it is essential to be sure about the accounts you are reviewing and investigate a lot about them. Make questions, look for supporting documents and call an expert if necessary.

Written by: Andrea Diaz

Related Articles:

Newsletters

Newsletter December 2021

NewslettersEvents & SponsorshipArticles & Publications

Newsletter – June 2021

NewslettersEvents & SponsorshipArticles & Publications

Newsletter – May 2021

NewslettersEvents & SponsorshipArticles & Publications

Newsletter – April 2021

NewslettersEvents & SponsorshipArticles & Publications

Newsletter – March 2021

NewslettersEvents & SponsorshipArticles & Publications

Events & Sponsorship

Toronto Entrepreneurs Conference @ Mississauga

May 08, 2019 Our B.E.S.T. (Business Entrepreneurs Services Team) Group has participated in this event for first time. Toronto Entrepreneurs Conference and Trade Show is the largest Entrepreneurs event in Canada. The event which targets business owners, partners or...

Hispanic Fiesta 2018

September 04, 2018 RGB Accounting will participate in this event for a second year in a row. Hispanic Fiesta will be held at Mel Lastman Square in Toronto during the Labour Day Weekend, August 31st, Sept. 1, 2, & 3, 2018. Hispanic Fiesta is a four-day celebration...

Secure Your Future Seminar 2018

June 20, 2018 This event gathered business owners running a small or medium-sized business, self-employed and incorporated businesses willing to learn tax saving strategies to help them utilize their company assets to secure their retirement. We are proud of having...

2nd Latino Business Expo Show

May 19, 2018 The 2nd Latino Business Expo Show held on May 19th at Daniels Spectrum gathered a wide range of entrepreneurs and business owners avid to learn how to take their businesses to the next level. RGB Accounting participated as vendor and speaker at this...

Hispanic Fiesta 2017

September 04, 2017 Hispanic Fiesta, a celebration of Spanish and Latin-American: Arts, Food, Music and Entertainment, is a four-day celebration filled with the splendid sounds, tempting treats and colorful culture featuring 300 local, national and International...

Articles & Publications

The Surprising Medical Expenses You Can Claim with the CRA!

The Surprising Medical Expenses You Can Claim with the CRA! In the realm of medical expenses, which are often deemed both essential and financially burdensome, the Canada Revenue Agency (CRA) emerges as a potential source of relief for Canadians. While the CRA...

Shareholder Owners Salaries vs Dividends

NewslettersEvents & SponsorshipArticles & Publications

Understanding the Shareholder Loan

Understanding the Shareholder Loan. How to Use it to your Advantage and Stay Compliant with CRA If you are the owner-manager of a corporation, understanding the concept of the shareholder loan is essential to running your business. Below I will explain what a...

GST/HST for digital economy businesses

GST/HST for digital economy businesses Overview New rules for digital economy businesses are in effect as of July 1, 2021. As of July 1, 2021, digital economy businesses, including digital platform operators, may have potential goods and services tax/harmonized sales...

Ten things to know before filing your tax return this year

Ten things to know before filing your tax return this year Here are ten things to keep in mind as you work your way through this tax season. The deadline The regular tax-filing deadline for most individuals is usually April 30, but you have until May 2 this year to...