The Canada Revenue Agency (CRA) launched the Canada Emergency Response Benefit (CERB) as the flagship COVID-19 program by the Canadian government in 2020. CERB became a lifeline for Canadians who lost income due to the pandemic. The program ended on September 27, 2020, and made way for CERB replacements.

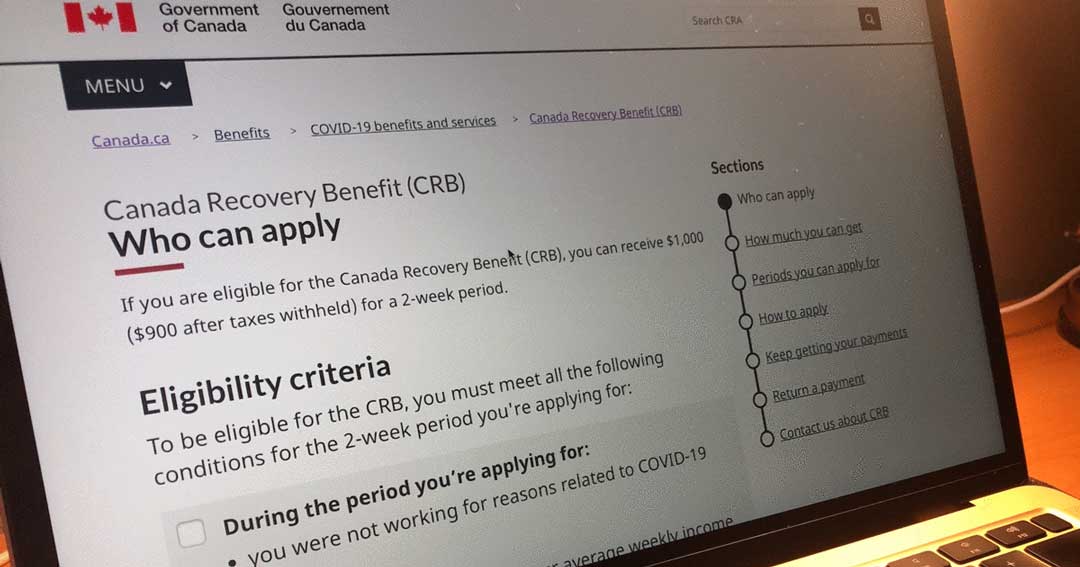

The federal government revamped the Employment Insurance (EI) system and introduced the Canada Recovery Benefit (CRB) to transition Canadians still in need of financial aid. With no visible end to the pandemic, despite hopeful developments on the vaccine front, the government announced two major updates for EI and CRB.

Maximum duration

Many CRB recipients are due to exhaust their benefits on March 27, 2021. The government’s announcement to update CRB and EI came right on time. One of the changes introduced by the CRA will be an extension of CRB from the original 26 weeks to 38 weeks. For regular EI benefits, the CRA has extended the period to 50 weeks for claims made between September 27, 2020, and September 25, 2021.

The federal government also extended the Canada Recovery Caregiving Benefit (CRCB) and Canada Recovery Sick Benefit (CRSB). The CRCB duration is also 36 weeks after the update, while the CRSB has been extended from two to four weeks.

CRA cash benefit amount

The CRA pays $1,000 for each two-week CRB eligibility period, which is actually $900 after the 10% withholding tax is deducted at the source. For self-employed individuals who prefer access to their EI benefits through Service Canada, the government has reduced the self-employed income threshold (for 2020 earnings) from $7,555 to $5,000.

You can earn income while you receive CRB, provided that your annual income for the calendar year will not go over $38,000. You will need to pay 50% of each dollar of your income that goes above $38,000.

If you qualify for the EI benefit, the minimum amount you can receive per week is $500 (subject to a 10% tax on payment), but some people may be eligible to receive up to $573 per week, depending on their previous income. The proceeds for both CRSB and CRCB are $450 per week (subject to a 10% withholding tax upon payment).

Source: CRA

Newsletters

Newsletter – February 2021

NewslettersEvents & SponsorshipArticles & Publications

Newsletter – January 2021

NewslettersEvents & SponsorshipArticles & Publications

Newsletter – December 2020

NewslettersEvents & SponsorshipArticles & Publications

Newsletter – October 2020

NewslettersEvents & SponsorshipArticles & Publications

Newsletter – September 2020

NewslettersEvents & SponsorshipArticles & Publications

Events & Sponsorship

Talent Kids Event 2017

August 19, 2017 RGB Accounting has proudly sponsored the 2017 Talent Kids event organized by Pecora Events on August 19th. RGB Accounting wants to thank organizers, presenters, judges, and all participants for making this a great event. Here we share some of the...

Los Nocheros USA/Canada Tour 2017

June 02, 2017 Argentina's biggest folkloric phenomenon arrived in Toronto, Canada to celebrate its 30 years trajectory. RGB Accounting was one of the sponsors of the event. More from our blog Newsletters Events & Sponsorship Articles &...

2nd Latin American Entrepreneur Conference

May 29, 2017 The Entrepreneur Conference was organized by the City of Toronto's Economic Development & Culture department in partnership with the Latin American Bi-Lateral Trade Initiative (LABTI) which consists of the Consulate Generals of Argentina, Brazil,...

Tax Season 2017 at La Liga Indoor Soccer

April 29, 2017 RGB Accounting has been sponsoring social events to promote cultural values in the hispanic community of Toronto and the GTA. The During the last tax season, RGB Accounting helped many individuals and small business owners to prepare their taxes,...

Articles & Publications

The Ultimate Bookkeeping Checklist for Canadian Small Businesses (CRA-Compliant)

The Ultimate Bookkeeping Checklist for Canadian Small Businesses (CRA-Compliant) Keeping accurate financial records isn’t just good practice—it’s a legal requirement under the Canada Revenue Agency (CRA). Whether you’re a solo entrepreneur, a growing small business,...

The Surprising Medical Expenses You Can Claim with the CRA!

The Surprising Medical Expenses You Can Claim with the CRA! In the realm of medical expenses, which are often deemed both essential and financially burdensome, the Canada Revenue Agency (CRA) emerges as a potential source of relief for Canadians. While the CRA...

Shareholder Owners Salaries vs Dividends

NewslettersEvents & SponsorshipArticles & Publications

Understanding the Shareholder Loan

Understanding the Shareholder Loan. How to Use it to your Advantage and Stay Compliant with CRA If you are the owner-manager of a corporation, understanding the concept of the shareholder loan is essential to running your business. Below I will explain what a...

GST/HST for digital economy businesses

GST/HST for digital economy businesses Overview New rules for digital economy businesses are in effect as of July 1, 2021. As of July 1, 2021, digital economy businesses, including digital platform operators, may have potential goods and services tax/harmonized sales...