Employment in Canada Decreased by 28,800 Jobs in December 2020

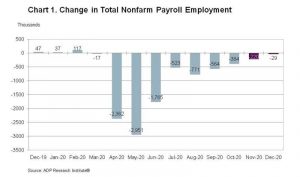

Employment in Canada decreased by 28,800 jobs from November to December according to the December ADP® Canada National Employment Report. Broadly distributed to the public each month, free of charge, the ADP Canada National Employment Report is produced by the ADP Research Institute®. The report, which is derived from actual ADP payroll data, measures the change in total nonfarm payroll employment each month on a seasonally-adjusted basis.

December 2020 Report Highlights*

|

|

|

Total Canada Nonfarm Payroll Employment1: -28,800

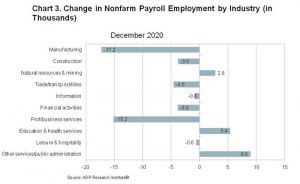

Industry Snapshot:

– Goods Producing:

- Manufacturing -17,200

- Construction -3,800

- Natural Resources and Mining 2,800

– Service Providing:

- Trade/Transportation and Utilities -4,600

- Information -800

- Finance/Real Estate -3,900

- Professional/Business Services -15,200

-Professional/Technical -10,900

-Management of Companies -500

-Administrative and Support -3,800 - Education & Health Care 5,400

-Educational Services 3,600

-Health Care 1,800 - Leisure and Hospitality -600

- Other Services2 9,000

* Sum of components may not equal total, due to rounding.

“December payrolls posted a decrease in jobs,” said Nela Richardson, chief economist, ADP. “While most industries saw declines led by the manufacturing; professional business services; and trade, transportation and utilities sectors; job gains were recorded in education and healthcare, and natural resources and mining.”

The November total of jobs added was revised from 40,800 to -219,800.

The January 2021 ADP Canada National Employment Report will be released at 8:30a.m.ET on February 18, 2021.

About the ADP Canada National Employment Report

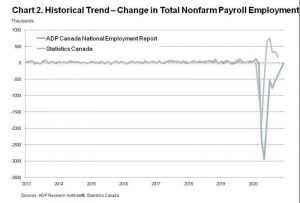

The ADP Canada National Employment Report is a monthly measure of the change in total Canada nonfarm payroll employment derived from actual, anonymous payroll data of client companies served by ADP Canada. The report, which measures more than two million workers in Canada, is produced by the ADP Research Institute®, a specialized group within the company that provides insights around employment trends and workforce strategy.

Each month, the ADP Research Institute issues the ADP Canada National Employment Report as part of the company’s commitment to adding deeper insights into the labour market in Canada and providing businesses, governments and others with a source of credible and valuable information. The ADP Canada National Employment Report is broadly distributed to the public each month, free of charge.

For a description of the underlying data and the statistical model used to create this report, please see “ADP Canada National Employment Report: Development Methodology”.

About the ADP Research Institute

The mission of the ADP Research Institute is to generate data-driven discoveries about the world of work, and to derive reliable economic indicators from these insights. We offer these findings to the world at large as our unique contribution to making the world of work better and more productive, and to bring greater awareness to the economy at large.

About ADP (NASDAQ: ADP)

Designing better ways to work through cutting-edge products, premium services and exceptional experiences that enable people to reach their full potential. HR, Talent, Time Management, Benefits and Payroll. Informed by data and designed for people. Learn more at ADP.com

ADP, the ADP logo, Always Designing for People and the ADP Research Institute are registered trademarks of ADP, Inc. All other marks are the property of their respective owners.

Copyright © 2021 ADP, Inc. All rights reserved.

1 Including 14 industries (cf. report methodology)

2 Including public administration

SOURCE ADP, Inc.

For further information: Keera Hart, Kaiser Lachance Communications, (905)-580-1257, [email protected], www.adp.com

Related Links

Newsletters

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Events & Sponsorship

Talent Kids Event 2017

August 19, 2017 RGB Accounting has proudly sponsored the 2017 Talent Kids event organized by Pecora Events on August 19th. RGB Accounting wants to thank organizers, presenters, judges, and all participants for making this a great event. Here we share some of the...

Los Nocheros USA/Canada Tour 2017

June 02, 2017 Argentina's biggest folkloric phenomenon arrived in Toronto, Canada to celebrate its 30 years trajectory. RGB Accounting was one of the sponsors of the event. More from our blog Newsletters Events & Sponsorship Articles &...

2nd Latin American Entrepreneur Conference

May 29, 2017 The Entrepreneur Conference was organized by the City of Toronto's Economic Development & Culture department in partnership with the Latin American Bi-Lateral Trade Initiative (LABTI) which consists of the Consulate Generals of Argentina, Brazil,...

Tax Season 2017 at La Liga Indoor Soccer

April 29, 2017 RGB Accounting has been sponsoring social events to promote cultural values in the hispanic community of Toronto and the GTA. The During the last tax season, RGB Accounting helped many individuals and small business owners to prepare their taxes,...

Articles & Publications

The Ultimate Bookkeeping Checklist for Canadian Small Businesses (CRA-Compliant)

The Ultimate Bookkeeping Checklist for Canadian Small Businesses (CRA-Compliant) Keeping accurate financial records isn’t just good practice—it’s a legal requirement under the Canada Revenue Agency (CRA). Whether you’re a solo entrepreneur, a growing small business,...

The Surprising Medical Expenses You Can Claim with the CRA!

The Surprising Medical Expenses You Can Claim with the CRA! In the realm of medical expenses, which are often deemed both essential and financially burdensome, the Canada Revenue Agency (CRA) emerges as a potential source of relief for Canadians. While the CRA...

Shareholder Owners Salaries vs Dividends

NewslettersEvents & SponsorshipArticles & Publications

Understanding the Shareholder Loan

Understanding the Shareholder Loan. How to Use it to your Advantage and Stay Compliant with CRA If you are the owner-manager of a corporation, understanding the concept of the shareholder loan is essential to running your business. Below I will explain what a...

GST/HST for digital economy businesses

GST/HST for digital economy businesses Overview New rules for digital economy businesses are in effect as of July 1, 2021. As of July 1, 2021, digital economy businesses, including digital platform operators, may have potential goods and services tax/harmonized sales...