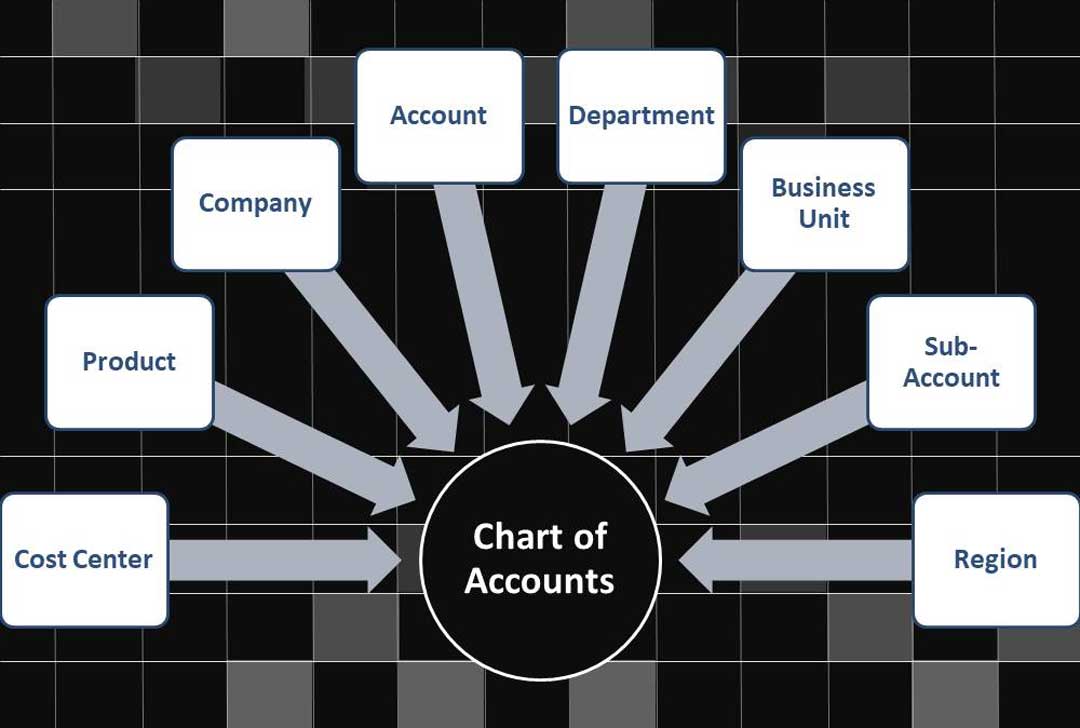

Setting up your chart of accounts properly is one of the most important things a business owner can do. We’ll explain what a chart of accounts is and why it’s so vital.

The chart of accounts lists all the accounts found in your general ledger, including both temporary and permanent accounts. It’s necessary to manage the financial transactions that your business makes appropriately.

Overview: What is a chart of accounts?

One of the first things you learn in accounting 101 is the importance of the chart of accounts. The backbone of your entire business, the chart of accounts, is where all of your general ledger accounts reside. The chart of accounts records every financial transaction that your company has made.

It will be different for each business type, with a manufacturing company using a separate chart of accounts than a service business or a nonprofit organization.

When set up correctly, your chart of accounts can provide you with detailed information about your business. And it helps to ensure that the information you do retrieve, such as financial statements, gives an accurate representation of your business.

How does a chart of accounts work?

Every time you deposit a payment, record a bill that needs to be paid next month, or send an invoice to a customer, it’s recorded in the general ledger using the accounts found in your chart of accounts. The chart of accounts contains five types of accounts:

- Asset accounts: Assets are anything that your business owns

- Liability accounts: Liabilities are anything that your business owes

- Equity accounts: Equity represents ownership of the business

- Revenue accounts: Revenue is the money earned from goods and services

- Expense accounts: Expenses are considered the cost of doing business

The first part of your chart of accounts houses balance sheet accounts such as assets, liabilities, and equity. In contrast, the second part of your chart of accounts lists your income statement accounts, which are revenue and expenses.

Every chart of accounts is structured this way, though you can add additional accounts or sub-accounts to better track transactions specific to your business type.

Examples of a chart of accounts

The accounts in a chart of accounts will vary depending on your business size and type. Below is an example of a chart of accounts for a small service business. The chart contains all five account types found in all accounting chart of accounts.

|

The best accounting software for the chart of accounts

Managing your chart of accounts is much easier when using accounting software. Whether you’re a one-person operation or have a staff of 10, here are some excellent choices to simplify the chart of accounts management for your business.

1. Kashoo

Kashoo combines an easy-to-use interface with solid accounting capability, including a default chart of accounts, an excellent choice for sole proprietors and new businesses. Unlike other software applications, Kashoo does not include an option for importing an existing chart of accounts.

Kashoo’s chart of accounts is entirely customizable.

Kashoo uses a basic chart of accounts structure which allows new users to choose their business type during product setup. Kashoo then creates the appropriate chart of accounts during the setup process.

Kashoo’s chart of accounts includes five account types: Assets, Liabilities, Equity, Income, and Expense, with the ability to create sub-accounts if necessary.

This structure, while simple, is sufficient for small businesses that don’t need to track inventory or purchase returns and allowances. Kashoo does fall short on reporting options, with limited reports available, though the application can run basic financial statements.

Kashoo’s pricing is straightforward and all-inclusive. The cost is $199/year, or $19.99/month, with no extra charge for additional users or features.

2. QuickBooks Online

QuickBooks Online is well suited to various small businesses, from the one-person operation to the growing business. QuickBooks Online offers a customizable chart of accounts structure and online banking, expense management, sales, and invoicing.

It also offers the option to upload an existing chart of accounts if you wish.

QuickBooks Online makes it easy to add a new account to your chart of accounts.

QuickBooks Online includes a default chart of accounts that it can easily customize to suit your business better. You can add departments or segments in your chart of accounts for better tracking.

Although you are limited to 250 accounts, that should be sufficient for most small businesses. In addition, QuickBooks Online offers good reporting options, including standard financial statements and reports designed for your accountant or CPA.

QuickBooks Online pricing starts at $10/month for the Simple Start plan, though most small and growing businesses would benefit most from the Plus plan, available for $35/month for the first three months.

3. AccountEdge Pro

AccountEdge Pro is well-suited for small and growing businesses, offering a wide variety of features, including a customizable chart of accounts, along with sales, time and billing, inventory, and payroll modules. AccountEdge Pro gives you the option to upload your chart of accounts.

AccountEdge Pro offers default numbering for all account types.

If you choose not to upload an existing chart of accounts, you can choose from 100 charts of accounts templates in AccountEdge Pro or create your own. The default chart of accounts includes account numbers and a number designating the account type. The numbers are:

- Assets

- Liabilities

- Equity

- Income

- Cost of Sales

- Expense

- Other income

- Other expense

For instance, all of your asset accounts will use the number 1, followed by four digits (1-XXXX), while all of your liability accounts would start with the number 2 (2-XXXX).

This structure is excellent for businesses that manufacture or sell products, and it’s a good fit for those looking for more flexibility in their chart of accounts structure. In addition, you can add sub-accounts for more in-depth tracking capability.

Reporting options in AccountEdge Pro are excellent, with customizable financial statements available.

AccountEdge Pro has a one-time fee of $399 for the on-premise application, while Priority Zoom, the cloud application, is $50/month, with both plans supporting up to five users.

The chart of accounts is the heart of your business.

Whether you’re a freelancer, a sole proprietor, or have been in business for years, your chart of accounts is the most critical component of your business.

From recording your operating expenses to managing your accounts payable, every transaction you make is registered in your chart of accounts. But remember, if your chart of accounts is not set up correctly, your financial statements won’t be accurate.

The best way for you or your bookkeeper to manage your chart of accounts is by using accounting software tailored for your business type. If you’re interested in a better accounting software solution for your business, check out The Blueprint’s accounting software reviews.

Source: fool.com

Newsletters

Newsletter – February 2021

NewslettersEvents & SponsorshipArticles & Publications

Newsletter – January 2021

NewslettersEvents & SponsorshipArticles & Publications

Newsletter – December 2020

NewslettersEvents & SponsorshipArticles & Publications

Newsletter – October 2020

NewslettersEvents & SponsorshipArticles & Publications

Newsletter – September 2020

NewslettersEvents & SponsorshipArticles & Publications

Events & Sponsorship

Talent Kids Event 2017

August 19, 2017 RGB Accounting has proudly sponsored the 2017 Talent Kids event organized by Pecora Events on August 19th. RGB Accounting wants to thank organizers, presenters, judges, and all participants for making this a great event. Here we share some of the...

Los Nocheros USA/Canada Tour 2017

June 02, 2017 Argentina's biggest folkloric phenomenon arrived in Toronto, Canada to celebrate its 30 years trajectory. RGB Accounting was one of the sponsors of the event. More from our blog Newsletters Events & Sponsorship Articles &...

2nd Latin American Entrepreneur Conference

May 29, 2017 The Entrepreneur Conference was organized by the City of Toronto's Economic Development & Culture department in partnership with the Latin American Bi-Lateral Trade Initiative (LABTI) which consists of the Consulate Generals of Argentina, Brazil,...

Tax Season 2017 at La Liga Indoor Soccer

April 29, 2017 RGB Accounting has been sponsoring social events to promote cultural values in the hispanic community of Toronto and the GTA. The During the last tax season, RGB Accounting helped many individuals and small business owners to prepare their taxes,...

Articles & Publications

Home office expenses for employees

Home office expenses for employees Calculate your expenses To understand the math behind the home office expenses calculation, refer to how the claim is calculated. To use the calculator, select from the options below. A temporary flat rate of $2 for each day you...

Tax impacts of leaving Canada to live elsewhere

Tax impacts of leaving Canada to live elsewhere. You must carefully consider numerous tax impacts before deciding to leave Canada to live elsewhere. Analyzing the termination of your tax residence is a question of fact. Generally, the Canada Revenue Agency will...

Selling your business shares to a family member?

Selling your business shares to a family member? A new law means significant tax relief when you pass your business on to your kids. A recent change to Canada’s Income Tax Act (ITA) could reduce the tax sting associated with selling your business shares...

Tax changes in the latest fiscal update.

Tax changes in the latest fiscal update. If you're working from home, you can claim up to $500 for office expenses with the temporary flat rate method There were very few broad-based tax changes in the recently released federal government's fall economic statement....

COVID-19 Update January 2022

COVID-19 Update Federal Expanding Access to the Local Lockdown Program (December 22, 2021) The Department of Finance announced that the government intends to expand the Local Lockdown Program eligibility to access the wage and rent subsidies to more...