Employment in Canada Decreased by 28,800 Jobs in December 2020

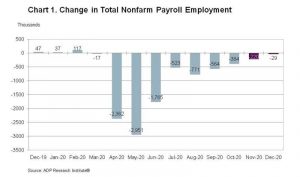

Employment in Canada decreased by 28,800 jobs from November to December according to the December ADP® Canada National Employment Report. Broadly distributed to the public each month, free of charge, the ADP Canada National Employment Report is produced by the ADP Research Institute®. The report, which is derived from actual ADP payroll data, measures the change in total nonfarm payroll employment each month on a seasonally-adjusted basis.

December 2020 Report Highlights*

|

|

|

Total Canada Nonfarm Payroll Employment1: -28,800

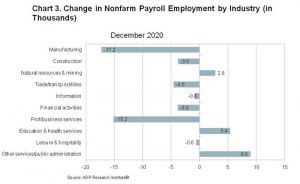

Industry Snapshot:

– Goods Producing:

- Manufacturing -17,200

- Construction -3,800

- Natural Resources and Mining 2,800

– Service Providing:

- Trade/Transportation and Utilities -4,600

- Information -800

- Finance/Real Estate -3,900

- Professional/Business Services -15,200

-Professional/Technical -10,900

-Management of Companies -500

-Administrative and Support -3,800 - Education & Health Care 5,400

-Educational Services 3,600

-Health Care 1,800 - Leisure and Hospitality -600

- Other Services2 9,000

* Sum of components may not equal total, due to rounding.

“December payrolls posted a decrease in jobs,” said Nela Richardson, chief economist, ADP. “While most industries saw declines led by the manufacturing; professional business services; and trade, transportation and utilities sectors; job gains were recorded in education and healthcare, and natural resources and mining.”

The November total of jobs added was revised from 40,800 to -219,800.

The January 2021 ADP Canada National Employment Report will be released at 8:30a.m.ET on February 18, 2021.

About the ADP Canada National Employment Report

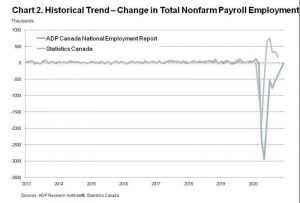

The ADP Canada National Employment Report is a monthly measure of the change in total Canada nonfarm payroll employment derived from actual, anonymous payroll data of client companies served by ADP Canada. The report, which measures more than two million workers in Canada, is produced by the ADP Research Institute®, a specialized group within the company that provides insights around employment trends and workforce strategy.

Each month, the ADP Research Institute issues the ADP Canada National Employment Report as part of the company’s commitment to adding deeper insights into the labour market in Canada and providing businesses, governments and others with a source of credible and valuable information. The ADP Canada National Employment Report is broadly distributed to the public each month, free of charge.

For a description of the underlying data and the statistical model used to create this report, please see “ADP Canada National Employment Report: Development Methodology”.

About the ADP Research Institute

The mission of the ADP Research Institute is to generate data-driven discoveries about the world of work, and to derive reliable economic indicators from these insights. We offer these findings to the world at large as our unique contribution to making the world of work better and more productive, and to bring greater awareness to the economy at large.

About ADP (NASDAQ: ADP)

Designing better ways to work through cutting-edge products, premium services and exceptional experiences that enable people to reach their full potential. HR, Talent, Time Management, Benefits and Payroll. Informed by data and designed for people. Learn more at ADP.com

ADP, the ADP logo, Always Designing for People and the ADP Research Institute are registered trademarks of ADP, Inc. All other marks are the property of their respective owners.

Copyright © 2021 ADP, Inc. All rights reserved.

1 Including 14 industries (cf. report methodology)

2 Including public administration

SOURCE ADP, Inc.

For further information: Keera Hart, Kaiser Lachance Communications, (905)-580-1257, [email protected], www.adp.com

Related Links

Newsletters

Newsletter – February 2021

NewslettersEvents & SponsorshipArticles & Publications

Newsletter – January 2021

NewslettersEvents & SponsorshipArticles & Publications

Newsletter – December 2020

NewslettersEvents & SponsorshipArticles & Publications

Newsletter – October 2020

NewslettersEvents & SponsorshipArticles & Publications

Newsletter – September 2020

NewslettersEvents & SponsorshipArticles & Publications

Events & Sponsorship

Talent Kids Event 2017

August 19, 2017 RGB Accounting has proudly sponsored the 2017 Talent Kids event organized by Pecora Events on August 19th. RGB Accounting wants to thank organizers, presenters, judges, and all participants for making this a great event. Here we share some of the...

Los Nocheros USA/Canada Tour 2017

June 02, 2017 Argentina's biggest folkloric phenomenon arrived in Toronto, Canada to celebrate its 30 years trajectory. RGB Accounting was one of the sponsors of the event. More from our blog Newsletters Events & Sponsorship Articles &...

2nd Latin American Entrepreneur Conference

May 29, 2017 The Entrepreneur Conference was organized by the City of Toronto's Economic Development & Culture department in partnership with the Latin American Bi-Lateral Trade Initiative (LABTI) which consists of the Consulate Generals of Argentina, Brazil,...

Tax Season 2017 at La Liga Indoor Soccer

April 29, 2017 RGB Accounting has been sponsoring social events to promote cultural values in the hispanic community of Toronto and the GTA. The During the last tax season, RGB Accounting helped many individuals and small business owners to prepare their taxes,...

Articles & Publications

Home office expenses for employees

Home office expenses for employees Calculate your expenses To understand the math behind the home office expenses calculation, refer to how the claim is calculated. To use the calculator, select from the options below. A temporary flat rate of $2 for each day you...

Tax impacts of leaving Canada to live elsewhere

Tax impacts of leaving Canada to live elsewhere. You must carefully consider numerous tax impacts before deciding to leave Canada to live elsewhere. Analyzing the termination of your tax residence is a question of fact. Generally, the Canada Revenue Agency will...

Selling your business shares to a family member?

Selling your business shares to a family member? A new law means significant tax relief when you pass your business on to your kids. A recent change to Canada’s Income Tax Act (ITA) could reduce the tax sting associated with selling your business shares...

Tax changes in the latest fiscal update.

Tax changes in the latest fiscal update. If you're working from home, you can claim up to $500 for office expenses with the temporary flat rate method There were very few broad-based tax changes in the recently released federal government's fall economic statement....

COVID-19 Update January 2022

COVID-19 Update Federal Expanding Access to the Local Lockdown Program (December 22, 2021) The Department of Finance announced that the government intends to expand the Local Lockdown Program eligibility to access the wage and rent subsidies to more...